Study: The Cost of Teen Driving Hits Low-Income Families Hardest

AUSTIN, Texas, January 14, 2019 (Newswire.com) - The Zebra, the nation's leading car insurance search engine, today released results of a nationwide study detailing the divide between teens who can afford to drive and those who can’t. Driving-age (16-18) teens from wealthy families are 51 percent more likely to drive than their low-income peers.

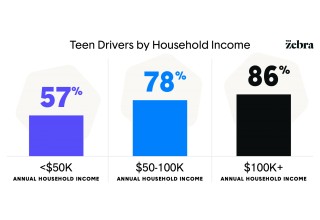

Teens who have their driver’s license by household income level:

- 57 percent of teens with incomes less than $50K

- 78 percent of teens with incomes $50-100K

- 86 percent of teens with incomes more than $100K

If Parents Can’t Afford It, Teens Don’t Drive

The report found that the higher a parents’ income, the more driving costs they covered for their teens — everything from gas to car insurance to parking tickets. In fact, one in three parents making less than $50,000 per year said their teen didn’t drive because their family couldn’t afford it.

Parents who can’t afford to pay their teens’ driving expenses by household income:

- 36 percent of parents with income less than $50K

- 15 percent of parents with income $50-100K

- 0 percent of parents with income more than $100K

“There’s no ignoring how prohibitive teen driving costs are to some families,” says Alyssa Connolly, Director of Market Insights at The Zebra. “Driving has long been considered a rite of passage. It gives teens mobility and independence. Unfortunately, that’s out of reach for many teens.”

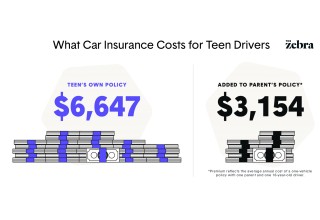

Car insurance is almost always the most substantial driving-related expense for teen drivers and their families, after the car payment itself. According to The Zebra’s research, the average parent pays upwards of $1,700 more per year to add a teen driver to their insurance policy. Still, that’s far less than what a teen driver would pay for their own policy: upwards of $6,000.

“Teens are outrageously costly to insure because they have almost no driving experience and are more likely to get in a crash and file an expensive insurance claim,” Connolly says. “The best thing families can do to lower these costs over time is to start building a history of insurance coverage for their teen and encourage safe and cautious driving.”

For additional statistics and information about teen drivers, including tips for teens and their families to save on costs, see the report www.TheZebra.com/research/teen-driving-and-income.

About The Zebra

The Zebra is the nation's leading auto insurance search engine. With its dynamic, real-time quote comparison tool, drivers can identify insurance companies with the coverage, service level, and pricing to suit their unique needs. The Zebra compares more than 200 car insurance companies and provides agent support and educational resources to ensure drivers are equipped to make the most informed decisions about their car insurance. Headquartered in Austin, Texas, The Zebra has sought to bring transparency and simplicity to insurance shopping since 2012 — it's “insurance in black and white.”

Media Contact:

Nicole Beck, The Zebra

(512) 842-9619

press@thezebra.com

Source: The Zebra