New Data Uncovers $250 Billion Profit Opportunity in Renewable Energy

SAN MATEO, Calif., March 26, 2018 (Newswire.com) - Despite the growth in the renewable energy sector, Mercatus has observed that project returns dropped on average 250 basis points (bps) over the investment decisioning life cycle from when a project was first approved for investment to when a project had completed its first year in operation. Furthermore, in certain more competitive regions, we have seen as much as a 400 bps drop when more aggressive assumptions ended up not delivering against expectations. To put this in perspective, for a $1 billion fund, a 250-400 bps drop across a portfolio could represent between $25 million to $40 million in lost profits due to the leakage of profits occurring across the investment life cycle.

This drop in returns is called IRR Deal Leakage, or the over-estimation of an asset's ultimate Internal Rate of Return (IRR). We started tracking this performance indicator in Mercatus five years ago and have found IRR Deal Leakage to exist across the energy and power industry independent of asset classes, from energy generation to storage technologies.

For a $1 billion fund, a 250-400 bps drop across a portfolio could represent between $25-40 million in lost profits due to the leakage of profits occurring across the investment life cycle.

Tim Buchner, COO

Where is the Leakage Occurring?

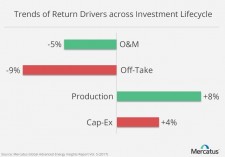

Looking across over 10,000 assets across 210 gigawatts of energy and power assets managed in Mercatus, the key drivers of IRR Deal Leakage stem from the inaccurate estimation and forecasting of four key project assumptions: the cost of operations and maintenance (O&M); the cost of energy (off-take); estimation of production; and estimation of capital expenditures (CapEx).

As shown in the accompanying table, off-take rates, in particular, are the highest and most commonly over-estimated values, as forecasts have predicted them to be on average nine percent higher at project inception than the actual value at the end of the first year of the asset’s operation. These mistakes in the investment life cycle can be devastating to project IRRs and must be more closely monitored and managed to prevent such wide variances of leakage.

A Root Cause of Diminishing Returns

Mercatus spoke to finance executives across the energy sector and invariably found that IRR Deal Leakage is one of the most pervasive issues impacting profitability, and one that few have been able to solve. Mercatus also found that a good first step in helping such executives find solutions is to help them consider why their IRR forecasts are so inaccurate. The Mercatus diagnostic process has consistently shown that the answer lies in how most investment organizations manage and utilize data, especially data used in conjunction with making investment decisions.

Executives agreed that the answers to these questions depend on the state of data management in their organizations. There is little to no centralization of critical data points like project assumptions and financial models, and there are many sources for the same information commonly stored and managed across multiple departments. To make informed investment decisions, organizations must reconcile these data sources to perform the above analyses, which often takes many days or even weeks. This is because most leverage spreadsheets as their source of truth for project information and assumptions. These “databooks” are rarely stored in a single location — often times, they are distributed across emails, desktops and sharing applications.

Additionally, finance teams leverage this scattered information within investment models, which also exist in spreadsheets that are not centrally located or controlled. In fact, for a single investment decision, most organizations average 80-100 iterations of these databooks and corresponding financial models with hundreds of changes in project assumptions across a project’s lifespan. As a result, most finance teams are simply overwhelmed sifting through the massive amount of data from disparate spreadsheets and other inconsistent data sources. Many organizations end up with little ability to extract data for insights like those illustrated in the accompanying table to help inform and minimize risk on investment decisions. Thus, executives are left with few to no leading indicators when investments are not performing to expectations or are at risk.

The Digitalization Opportunity

Owners of energy assets are carefully examining their data management strategies. By taking the issue head-on, asset owners are transforming their organizations to improve profits and prevent IRR Leakage. As shown, a $1 billion fund alone could see $25 million to $40 million in lost profits. If that same fund could capture just 15-20 percent of these lost profits, the organization can easily take back $4 million to $8 million in profit, which should be welcome news to any energy asset owner.

Source: Mercatus