Mercatus Finds ITC Tariffs Will Create 214 Basis Point IRR Decrease

SAN MATEO, Calif., November 8, 2017 (Newswire.com) - With the release last week of the U.S. International Trade Commission (ITC) recommendations on the Section 201 solar trade case, power producers may face an uncertain future. From the perspective of Mercatus, Inc., a cloud-based software company that serves the unique needs of renewable energy developers and asset owners, the imposed tariffs could lead to a 214 basis point decrease in the After-Tax Internal Rate of Return (AT-IRR) for utility-scale solar projects in the U.S.

The ITC proposal includes a 30 percent tariff on imported panels that would phase down in 5 percent increments over a four-year span. While less severe than the $0.32 per Watt tariff rate and $0.74 per Watt floor price requested by petitioners Suniva and SolarWorld Americas, the final decision on the tariff lays with President Trump, who has until Jan. 12 to take action. The final outcome could be far worse as the President continues to wage war on renewable energy to prop up the coal industry.

One CEO of a major power producer told me that a rapid 10 percent drop in profits could kill his company. Think of how a tariff that represents a 214 basis point decrease in AT-IRR might impact investor sentiment.

Haresh Patel, CEO, Mercatus

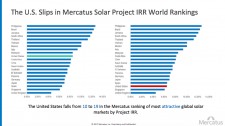

"Trump has every right to ignore the ITC recommendation and institute even more than the requested tariffs. That could kill the solar industry in the United States," says Haresh Patel, CEO of Mercatus. According to Mercatus data, the tariff as requested by Suniva and SolarWorld Americas would result in a 214 basis point decrease in AT-IRR for utility-scale solar projects in the U.S. The United States would drop from #9 to #19 in the Mercatus ranking of Most Attractive Global Solar Markets by Project IRR, which would likely cause investors to flee to more profitable markets.

"One CEO of a major power producer told me that a rapid 10 percent drop in profits could kill his company. Think of how a tariff that represents a 214 basis point decrease in AT-IRR might impact investor sentiment," Patel adds.

This compounds the issues that power producers already face when it comes to shaky investor confidence. One challenge is a lack of access to real-time, accurate data which hinders a power producer's ability to make investment decisions, limiting its chances of achieving profitable growth.

With the additional pressure of potential tariffs, Patel hypothesizes that it will be more critical than ever before for power producers to invest in data visibility and consistency in processes so the executive team can make smarter, more accurate resource and capital allocation decisions. "In this market, the ability to make strategic investment decisions quickly is key," he says. "And, the ability to do so with confidence is the difference between failure and profitable growth," he adds.

To learn more about the challenges of power producers in today's highly competitive global energy market, visit http://gomercatus.com/blog/investment-decisions. For inquiries about this information and more, contact Carolyn Murphy at cmurphy@gomercatus.com.

About Mercatus

Mercatus is a cloud-based software company that serves the unique needs of energy developers and asset owners. Mercatus Energy Investment Lifecycle Management (ILM) is the only integrated software platform that automates the full asset investment life cycle, from origination through end-of-life, enabling energy companies to grow their portfolio faster while lowering their risk profile. Mercatus' customers are some of the largest energy companies that collectively leverage the Energy ILM platform to manage over 110 GW of projects, across 75 countries, using eight advanced energy technologies. Mercatus is headquartered in Silicon Valley and has offices in Europe and India.

Source: Mercatus, Inc.