ECA Partners Announces Survey on the Impact of the Economic Downturn on Private Equity

SANTA MONICA, Calif., April 16, 2020 (Newswire.com) - ECA Partners today announced survey results of over 100 Private Equity (PE) professionals on how the COVID-19 downturn is impacting their strategic priorities.

Selected findings include:

- PE investors are, on average, spending 47% of their uninvested funds to strengthening existing portfolio companies, a 7% increase

- 27% of PE investors plan to do more deal sourcing than before COVID-19

- Most investors expect PE revenues to return to pre-COVID levels by Q4 2020 or Q1 2021

- Investors have a positive outlook on the future. Investors on average believe the Dow Jones Industrial Average will rise by 10% over the next 12 months

"Private Equity investors have close to $1 trillion in dry powder,” said Atta Tarki, CEO and Founder of ECA Partners. “A number of these investors are telling us that they will be using those funds over the next few months to capitalize existing portfolio companies.”

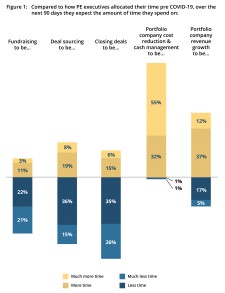

The survey results show a clear shift in priorities among PE executives, from deal-making to a proactive focus on cost control initiatives across their portfolios. In fact, 87% of respondents reported that they plan to spend more time managing costs over the next 90 days. “A lot of PE firms are actually viewing this as an opportunity to explore maintenance projects, such as property renovations, given the sudden drop in day-to-day activity,” said Ken Kanara, ECA’s President and co-author of the survey.

Despite this focus on controlling costs, the survey also highlights many ways in which PE executives are already planning for the eventual rebound. As Tarki notes, “Many investors realize they can’t produce positive returns on their existing investments by purely focusing on defensive strategies and reducing costs. They also need offensive strategies in order to grow revenues as soon as the economy picks back up.”

Equally, the survey shows that PE executives are preparing for a new round of investments. "Some funds,” Tarki explains, “are keeping their calm in the eye of the storm - raising capital and adding to their investment teams as they expect more lucrative investment opportunities to surface by the end of the year. General Atlantic, for example, announced earlier this week they are forming a $5 billion fund aimed at investing in distressed assets."

The survey offers a snapshot of private equity in the United States. Respondents hail from tenured committed funds, family offices and fundless sponsors, ranging from small ($0-100M assets under management) to very large (more than $10B assets under management).

About ECA Partners

ECA Partners is a leading search firm specializing in placing top candidates in permanent project and interim roles with PE funds and their portfolio companies. Founded in 2010, ECA is a leading proponent of evidence-based methods in the recruitment and evaluation of talent. Its founder, Atta Tarki, is the author of the book Evidence-Based Recruiting (McGraw Hill, February 2020).

Media Contact:

Atta Tarki

Phone: +1 310 880 6116

Email: atarki@eca-partners.com

Source: ECA Partners