'Do I Need a Wealth Manager?' How to Find a Trustworthy Wealth Manager

NEW YORK, August 11, 2020 (Newswire.com) - A trustworthy wealth manager can make the difference between simply being wealthy and empowering one’s relationship with one’s wealth. By taking on the responsibility of managing a person’s assets and finances, a skilled wealth manager, like those in the Zoe Financial network, lifts the burden of having to stress about investment volatility, high taxes, and retirement and estate planning. That said, when thinking about how to find a wealth manager, keep in mind that not all wealth managers will be trustworthy or “fiduciary”.

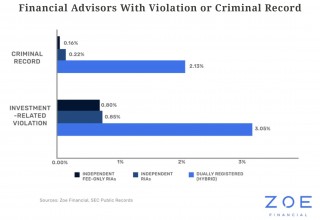

Considering the wealth management industry has been dominated by registered independent advisors (RIA) with misaligned incentives, it’s no surprise that finding a trustworthy wealth manager is particularly challenging. Upon conducting a thorough investigation of the Securities and Exchange Commission (SEC) RIA Reports, as well as the SEC ADV form and numerous academic papers, Zoe Financial’s independent research found that of 26,809 independent advisors, only 6,845 were U.S.-based and SEC-registered. That number removed mutual and hedge funds, retirement consultants, automated Robo-advisors, and third-party asset managers, as those all have potentially misaligned intentions with a client’s funds. Within that sample size of 6,845 unique U.S.-based wealth managers, 4.7% had investment-related violations and 2.51% had criminal records.

If one thing is clear, it’s that finding a wealth manager you can trust is not easy. By understanding exactly what a wealth manager does, knowing which areas they should be experts in, and learning how to effectively interview an RIA, one can more easily spot a trustworthy wealth manager.

What is a Wealth Manager?

A wealth manager helps their clients organize and optimize their money. Specifically, wealth managers address the needs of their affluent clients. Although a wealth manager is a type of financial advisor, they differ from the average advisor.

These advisors help their clients maintain their wealth, build on their success, and help empower them to reach their financial goals. Wealth managers use a wide range of skills and years of expertise to make the construct a financial plan for their clients.

Top 3 Areas of Wealth Manager Expertise

There are certain financial areas that a wealth manager should be an expert in. When a person is looking for a wealth manager, they should look for somebody that has knowledge in these areas:

1. Retirement Planning

Saving for retirement is going to be one of the biggest savings goals you will have in your lifetime. A wealth manager will ensure that planning for your retirement is a part of your holistic financial plan. They will work with you to make sure that you are saving in the most effective, and tax-efficient manner. Regardless of where you land in preparing for retirement, finding your footing can be easy.

Zoe Financial emphasizes the importance of planning for retirement. They state, “Your goal is to build a large enough ‘nest egg’ for yourself so that when you reach retirement age, you have enough to pay yourself a salary each year so that you can enjoy that long vacation without worrying if you’re going to run out of money.” Wealth managers in the Zoe network help their clients save in a tax-efficient way by choosing the right type of retirement account.

2. Tax Strategy

One of the downsides of wealth is the taxes that come with it. Since taxes are a constant part of life, a great tax strategy can save a person thousands of dollars. Wealth managers should have experience in this optimizing tax strategy for their clients, as it can help their clients maximize their financial plan and achieve their goals. In fact, a good wealth manager can increase returns by up to 3% annually!

A wealth manager must analyze their clients' finances, assets, and liabilities to make a great tax strategy. They also consider the timing of income, size, the timing of purchases, and selection of investments. Zoe Financial understands that tax planning for retirement plans is essential. By carefully considering each client’s situation, Zoe network advisors are able to recommend tax strategy options to help clients achieve their goals.

3. Estate and Inheritance Planning

When an individual receives an inheritance, it can drastically change their financial situation. Although new wealth is great, it can be overwhelming. For example, the benefactor’s house may have a lot of federal estate taxes. Or maybe the price of the inherited stock will be adjusted to the fair market value, causing short-term or long-term capital gain taxes when the individual sells the stock.

An experienced wealth manager can help their clients handle their new wealth, as well as recreate their financial plan to match their new budget and goals. Zoe Financial provides clients access to the top network of coast-to-coast estate and inheritance wealth managers.

Questions to Consider When Evaluating a Wealth Manager

When wondering how to find a wealth manager, clients should come up with a set of questions to ask a potential wealth manager. These questions will help the individual to better understand what they value in a wealth manager. The type of questions a person should ask depends on what they are specifically looking for, but there are general questions that they should ask as well, including:

● Are they a fiduciary?

● How do they get compensated?

● What financial planning and wealth management services do they offer?

● What is their firm’s philosophy?

● Are they associated with any broker-dealer?

Discover a Trustworthy Wealth Manager With Zoe Financial

Wealth managers are essential in empowering their clients' relationship with their wealth. A trustworthy advisor who is an expert at lifting the burden of investment volatility, high taxes, retirement and estate planning can make all the difference. At Zoe Financial, wealth managers are matched with their clients based on their areas of expertise. Zoe’s award-winning, AI-driven algorithm matches fiduciary wealth managers based on the unique life situation and goals of clients. Zoe Financial’s thorough vetting process ensures only the top 5% of financial advisors across the country are accepted into their network. Each client can feel confident, knowing they are hiring the right wealth manager for their goals.

About Zoe Financial

Zoe Financial’s award-winning algorithm enables individuals to discover and connect with highly vetted, top fiduciary advisors in their area. All financial advisors in the Zoe Network are vetted and verified fiduciaries, along with having top credentials, education, and experience. Zoe’s service provides support from start to finish during an individual's financial advisor search. All consultation calls and interviews with Zoe’s network of advisors are completely free and are offered via video chat or traditional phone call depending on an individual’s preference.

Press Contact:

press@zoefin.com

Source: Zoe Financial