Collectius Acquires a 100 Million USD Non-Performing Loan (NPLs) Portfolio in the Philippines. The Transaction Permits Collectius to Support 170,000 Debtors to Become Debt Free.

MANILA, Philippines, July 3, 2018 (Newswire.com) - Collectius acquires their second non-performing loan portfolio (NPLs) from a financial institution in the Philippines. The deal with a local bank further strengthens Collectius's position as the preferred debt purchaser of consumer non-performing loans (NPLs) in the ASEAN region. This is in line with Collectius's strategy to serve as the trusted partner to leading banks and financial institution in the ASEAN region in their handling of non-performing loans (NPLs).

Collectius is bringing capital, employment opportunities, know-how and systems in debt purchasing on consumer non-performing-loans (NPLs), using the collection approach of care, counseling and mediations to help its debtors to become debt free. Collectius's goal is to unburden their debtors and to integrate them into a lifestyle free from debt again.

"This bank deal is another major stepping stone for Collectius in the Philippines and our second bank deal in just a few months; we are really getting closer to our short-term target of 1 million customers! We are hungry to grow and the funds ready to support the growth," says Ivar Bjorklund, Head of Portfolio Acquisition in Collectius Group.

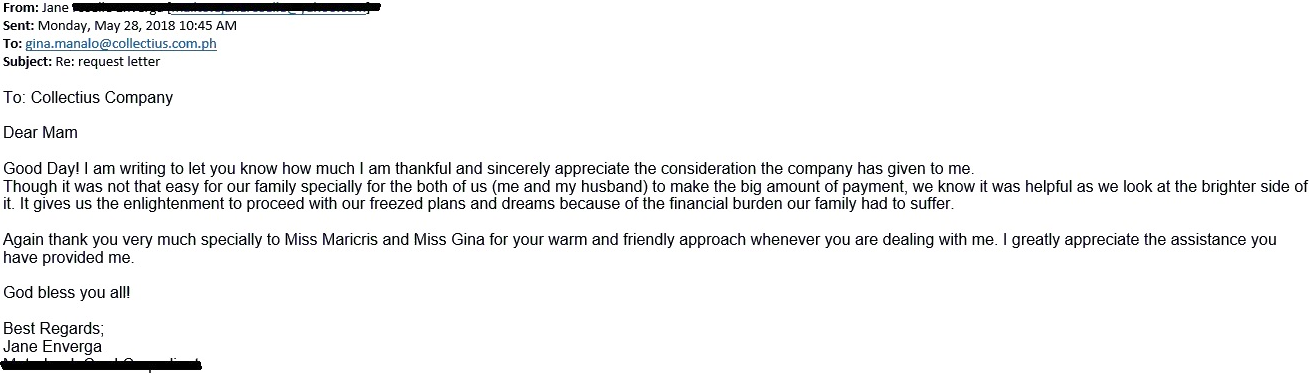

"We are delighted to have our second acquisition in the Philippines - it is a strong signal that the financial industry is confident with how Collectius have managed our acquisitions. We have also upheld our vision to help customers to become debt free," says Kian Foh, Then Managing Director Collectius Philippines; referring to the photographed letter from one of Collectius Philippines' many customers.(see below)

Photo: the Collectius team in Manilla are ready to help 170 000 new customers to become debt free

Taken by: Collectius

Collectius Group:

Collectius Group is a multinational credit management service and asset management company with operation in Philippine, Singapore, Malaysia and Thailand. With nearly two decades of experience in credit management

service and purchase of non-performing loan portfolios of distressed consumer debt. Collectius is funded through its Swiss holding company in Zug, and its largest financier is Stena, which is a Swedish shipping company conglomerate.

"This deal is a part of many daily steps that Collectius makes to reach our Mission and Vision; enabling our customers, a debt free life, by reshaping debt collection through technology & mediation, making each point of contact a positive beginning," says Gustav A. Eriksson CEO Collectius Group.

Source: Collectius Group