Terry Sacka Addresses the Future of the U.S. Dollar as World Reserve Currency

West Palm Beach, Florida, July 30, 2014 (Newswire.com) - The dollar's role as the world's primary reserve currency is what helps to keep interest rates low in the United States. Foreign countries purchase U.S. Treasury debt since dollar-denominated assets are the best way to hold foreign exchange reserves.

Foreign countries all over the world hold financial reserves in some form of currency and the U.S. dollar is the most common currency for international reserves. The recent budget crisis, debt ceiling crisis and the 2011 credit rating downgrade have made the U.S. economy look relatively shaky. This has even prompted Liu Chang for China’s official news agency Xinhua to release the statement, “It is perhaps a good time for the befuddled world to start considering building a de-Americanized world.”

It's not that things are more expensive because of quality, matter of fact it's the opposite, I call it stealth inflation - quality is actually going backwards. They keep money and there's nothing to back it. We cannot remain reserve world currency forever, no one has, and our time is coming.

Terry Sacka, AAMS, Founder of Cornerstone Asset Metals

Terry Sacka, AAMS is a financial analyst and founder of Cornerstone Asset Metals in Jupiter, Florida. He assists and guides investors on how to use precious metals in the form of physical assets such as gold and silver to hedge against systematic and inflationary risk and preserve their hard-earned wealth. He is a regular speaker and guest on The Wealth Transfer show with host Charles Vance, and recently appeared on two separate segments to introduce and then go into depth on the future of the dollar as world reserve currency.

Terry Sacka and Charles Vance opened the program with several statements addressing the moral and spiritual perspective of the transfer and ownership of wealth. They moved on to address the state of the big picture of the world economy.

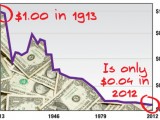

Approximately nine minutes into the program Mr Sacka made the statement, "We have a such an unbelievable financial condition globally where every country seems like they are printing unbelievable money and they have to...if one country prints the others have to print. So by printing this paper money its causing the value of that money to go down which causes inflation on goods and services. That's why you're paying four dollars for gas, higher food bills and everything else is more expensive."

FX Empire Analyst Barry Norman recently printed an article, The Global Reserve Currency: A “Changing of the Guard”?, that touches on the phrase "changing of the guard" and it's modern meaning referring to any shift in power or influence that is characterized by an old way of doing things being replaced by a new way. This tied in directly with Mr. Sacka's statements, "It's not that things are more expensive because of quality, matter of fact it's the opposite, I call it stealth inflation - quality is actually going backwards. They keep printing money and there's nothing to back it. We cannot remain reserve world currency forever, no one has, and our time is coming."

These statements highlight the fact that the US dollar which has effectively been the world’s reserve currency for the past 93 years but since its departure from the gold standard in 1971, it has been under increasing pressure for displaying those same traits that brought down the dominant monies of the past … debt, waste, war, quantitative easing policies, deficit spending, and political divide.

Mr. Sacka explained the ramifications of the effects of money printing in many real world examples and frequently posts this information on his website and blog. His website features many interesting videos providing historical insight into the power of gold and silver, information on how to protect the IRA and 401K with precious metals and the Wealth Transfer Archive where all of his appearances on the show can be viewed at http://www.cornerstoneassetmetals.com

About Terry Sacka

Terry is a financial analyst and accredited asset management specialist (AAMS) at Cornerstone Asset Metals, a private bullion dealer located in Jupiter Florida. The company enables investors, both large and small, to use metals such as gold, silver, platinum and palladium as an effective hedge for their retirement accounts against inflation. The company mission is to put people back in charge of their wealth through tangible assets that have been used as a medium for exchange since the dawn of civilization.

Cornerstone Asset Metals 601 Heritage Drive, Suite 104 Jupiter, FL 33458 (888) 747-3309