Wisconsin Small Business Borrowing Up in June

CHICAGO, August 9, 2017 (Newswire.com) - PayNet, the premier provider of small business credit data and analysis for the commercial and industrial lending industry, reports that in June 2017 borrowing is increasing in Wisconsin. Of the 18 major industries, 10 rose and 8 fell in Wisconsin.

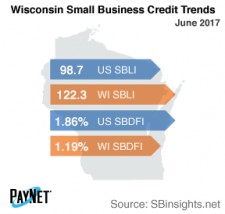

Wisconsin's PayNet Small Business Lending Index (SBLI) ranked 3rd in the country at 122.3, rising 1.1% from last month's state level to a value 23.9% better than the national SBLI level of 98.7 this month. We can cautiously anticipate improving financial conditions in Wisconsin based on recent small business investment.

The three industries with the greatest improvement in lending activity over the past year in Wisconsin were Information (37.1%); Mining, Quarrying, and Oil and Gas Extraction (27.3%); and Accommodation and Food Services (23.5%). Nationally, Information grew by 2.1% year over year.

Following a comparable performance to May, Wisconsin's PayNet Small Business Default Index (SBDFI) of 1.19% was one of the lowest in the country and was 67 basis points under the national SBDFI level of 1.86%. The national SBDFI rose 16 basis points compared to last year, whereas Wisconsin's SBDFI dropped 4 basis points.

"The recent increase in risk taking and defaults results from greater investment," explains William Phelan, president of PayNet.

Source: PayNet