Washington Small Business Borrowing Pulls Back in September, Default Rate Deteriorates

Olympia, Washington, November 21, 2017 (Newswire.com) - Borrowing by small firms in Washington declined and the percentage of firms defaulting on loans worsened in September 2017, according to data published by PayNet.

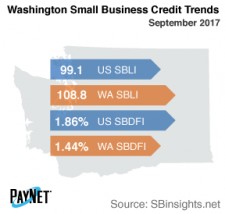

At 108.8, Washington's PayNet Small Business Lending Index (SBLI) surpassed the national SBLI level (99.1) despite dropping by 2.1% from last month's state level. The index is basically unchanged from a year ago.

The recent performance of defaults matches a sluggish lending environment.

William Phelan, President

The three industries with the most unfavorable change in lending activity over the past year in Washington were Accommodation and Food Services (-21.8%); Transportation and Warehousing (-13.4%); and Agriculture, Forestry, Fishing and Hunting (-12.8%). Nationally, Accommodation and Food Services grew by 3.2% year over year.

Despite a 2 basis point rise from August, Washington's PayNet Small Business Default Index (SBDFI) of 1.44% was still 42 basis points under the national SBDFI level of 1.86%. Washington's SBDFI climbed 18 basis points year-over-year, while the national SBDFI increased 7.

"The recent performance of defaults matches a sluggish lending environment," explains the president of PayNet, William Phelan.

Source: www.paynet.com