UK Small and Medium-Sized Online Retailers Face Decreasing Access to Major Payment Providers and Struggle With High Fees

CITY OF LONDON, England, December 11, 2023 (Newswire.com) - Small and medium-sized UK based online retailers, with annual turnovers below £10 million find themselves grappling with limited access to major payment providers and burdened by increasingly costly fees.

The key issue is the disparity in payment options for smaller businesses vs enterprise. Major payment providers often impose stringent criteria and higher fees, making it harder for SMEs to secure favourable terms limiting ability to offer payment optionality. Research from Baymard Institute shows over 70% of buyers abandon their shopping cart because of poor, complicated checkout experience and not seeing their preferred payment method.

David Nunn, Founder / CEO, Rvvup commented, “Some of our customers are frustrated by decreasing access to certain payment providers and higher payment fees due to their turnover being below £10m. With so much technology advancement, businesses of all sizes should be able to access the latest payment methods and associated lower processing fees.”

To foster a level playing field for businesses of all sizes, the UK Government is encouraging innovation in payments, particularly in open banking with success being healthy competition on fees and better consumer experiences. Additionally, an environment that encourages growth of SMEs in the online retail sector, driving innovation, creating jobs, and contributing to the overall economic health of the UK.

Recently the Bank of England has issued a Cross-authority roadmap on innovation in payments which sees increasing innovation in payments as crucial. This focus has the potential to support the development of solutions that empower SMEs to thrive in the digital economy.

Key concerns highlighted by SMBs include:

Limited Access: Particularly SMEs with less than £10m turnover, due to certain providers only onboarding businesses above a certain revenue threshold, making it more difficult to offer the payment options their customers want.

High Fees: Existing fee structures based on layers of legacy technology infrastructure disproportionately affects smaller businesses, eating into profit margins and hindering their ability to grow and innovate.

Innovation Stifled: Barriers to entry created by limited access and high fees, while maintaining the status quo, can stifle innovation, preventing the emergence of new players and limiting consumer choice.

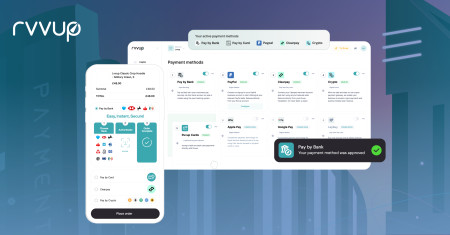

Experts are optimistic that addressing these challenges will benefit SMEs creating a more competitive e-commerce landscape. Rvvup offers enterprise functionality and multiple payment methods through a single interface - equally for SME businesses and larger enterprise customers. 24% of Rvvup’s customers are already saving over £200k per year in fees with attractive new payment methods.

The right future is one with a level playing field - an inclusive and supportive environment for small and medium-sized online retailers.

Source: Rvvup Payments