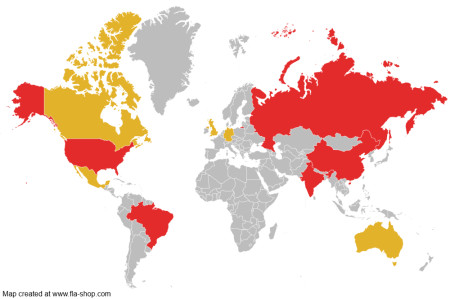

UK, Ireland, Germany, India, France, Saudi Arabia, and Brazil Reshape the Global EHR Landscape in 2025 - Black Book Study Update

Seven countries take center stage as new survey results reveal which national health systems are fast-tracking - or falling behind - in digital health transformation.

NEW YORK, May 12, 2025 (Newswire.com) - Black Book™ Research today released a detailed country-level supplement to the Q2 2025 Global Healthcare IT Report, spotlighting the complex landscape of electronic health record (EHR) adoption across the world. Drawing on responses from 11,054 healthcare IT executives, clinicians, and decision-makers across 44 countries during Q1 2025, the new findings emphasize the dramatic differences in EHR progress and setbacks across seven key nations.

"These findings go far beyond adoption metrics as they provide a lens into the regulatory, financial, and political forces uniquely shaping digital health outcomes in each country," said Doug Brown, President of Black Book Research. "As EHR systems become foundational to national health strategies, we're seeing nations assert data sovereignty, demand localized interoperability, and shift procurement based on geopolitical alignment. Black Book's global reach now spans over 100 countries and tens of thousands of verified health IT leaders, enabling us to track how vendor performance aligns with real-world clinical and operational success. This depth of insight is essential for stakeholders navigating the complex landscape of international health IT modernization."

Top Country-Level Insights from the Q1 2025 Survey

United Kingdom:

Despite progress in NHS interoperability standards, 64% of respondents from England's hospital trusts reported stalled digital projects due to central funding delays and restructuring turmoil. Regional EHR vendors are gaining traction in Scotland and Northern Ireland due to localized procurement flexibility.

Ireland:

While pilots under the Sláintecare program are advancing, 57% of Irish respondents cited inconsistent procurement strategies and IT staffing shortages as barriers. A notable shift toward non-U.S. vendors, particularly Dedalus, Comarch, and Philips Tasy, was attributed to faster localization and GDPR-aligned compliance.

Germany:

With 78% of German respondents expressing confidence in the Hospital Future Act (KHZG), regulatory ambiguity around consent and data residency still caused friction, according to 41% of IT executives. Regional vendors like Dedalus and Meierhofer led satisfaction scores in workflow customization and legal alignment.

India:

Survey feedback from India reflected bifurcated progress. While public sector adoption under the Ayushman Bharat Digital Mission surged, 53% of private hospital respondents cited lack of skilled staff and infrastructure as key barriers. Fragmentation across states continues to hamper national cohesion.

France:

83% of French providers rated their government's modernization efforts favorably. However, retaliatory tariffs and digital sovereignty debates led 71% to deprioritize certain EHR procurement sources in Q1 2025, turning instead to European firms perceived as more stable and aligned with national policy.

Saudi Arabia:

A model of rapid digital transformation, Saudi Arabia's Vision 2030 health goals have translated into 76% satisfaction among surveyed hospital IT leaders. Yet, private sector integration challenges persist. Orion Health and Health Insights gained market share with cloud-native, bilingual systems suited for Gulf-wide compliance.

Brazil:

81% of public hospital administrators praised progress under the e-SUS initiative, with MV Sistemas and Philips Tasy leading national deployments. Nonetheless, 62% of rural providers cited affordability and mobile-first design as critical gaps in achieving universal adoption. Regional champions continue to gain traction through deeper alignment with Brazil's Ministry of Health strategies.

Global Implications and Market Realignment

The report reveals clear signs of a vendor realignment favoring regional and multi-national EHR platforms that offer greater local adaptability, compliance readiness, and cloud-native flexibility. In these seven nations, procurement strategies are increasingly driven by geopolitical and regulatory shifts - not just product functionality.

"As EHR systems become geopolitical assets, nations are asserting sovereignty through technology choices," Brown said. "Vendors who understand and respond to these local demands will define the future of global healthcare IT."

The full Q2 2025 Global Healthcare IT report and country-level supplement are available for download at no cost to stakeholders at:

🔗 https://blackbookmarketresearch.com/register-for-the-black-book-of-global-healthcare-it-2025-report Contact research@blackbookmarketresearch.com for a copy of the Q2 2025 Updated supplement.

Source: Black Book Research