The Top Benefits of Hiring a Financial Advisor

NEW YORK, July 7, 2020 (Newswire.com) - During an economic crisis, a high-quality financial plan is essential. Even those who are usually great with money are feeling worried about their financial situation. Financial advisors help their clients reach their financial goals by creating a holistic financial plan; which includes investing wisely, buying a home, college planning, and preparing for retirement. Simply put, a financial advisor acts as a household chief financial officer (CFO).

Now more than ever, a CFO is critical for the success of a business. According to David Axson, former Managing Director at Accenture, “In virtually every company we look at, the CFO is becoming the second most important C-suite executive.” In the same manner, a fiduciary financial advisor takes on the role of a household CFO by helping you look at your finances holistically. By creating a lifelong financial plan, your financial advisor drives wealth creation.

The Benefits of a Financial Advisor

Financial advisors provide a number of benefits to their clients. Just like a CFO, a financial advisor works on incorporating risk management, budgeting, tax strategies, and wise investing principles into your financial plan in order to produce meaningful improvements in your financial life. Although many advisors promise this type of high-touch service, the reality is that most of their practices are stuck in the past trying to add value via attempting to “beat the market.”

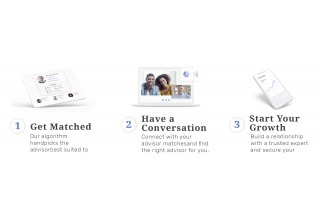

Zoe Financial is a leader in connecting consumers with fiduciary financial advisors whose expertise lies in creating unique financial strategies for your individual goals, instead of attempting to “beat the market.” Zoe’s AI-driven algorithm helps you discover, interview, and hire your ideal advisor from their carefully curated network of top advisors in your area. Zoe’s matching system takes into account your specific financial goals and situation, in order to connect you with the best advisor fit, at no cost.

The Importance of Retirement Planning

For many Americans, retirement is the end goal of a lifelong financial plan. As Zoe Financial Founder & CEO, Andres Garcia-Amaya, states “one of the biggest benefits of a financial advisor is that they will help each client be better prepared for their retirement, even during a financial crisis.” According to a study from Vanguard, a good financial planner can increase your returns by as much as 3% annually. It’s more important than ever to keep a close eye on your future financial goals as you look to jumpstart your retirement planning.

Long-Term Planning is Essential

As your household CFO, a financial advisor can make all the difference in helping you achieve your objectives, regardless of the state of the economy or the markets, by creating a comprehensive financial plan. Research by HSBC confirms the importance of preparing a financial plan: “Individuals with financial plans accumulated nearly 250% more in retirement savings than those without a financial plan in place. In addition, nearly 44% of those who have a financial plan in place save more money each year toward retirement.” A financial advisor’s benefits to your financial health are abundant, but often, finding the right advisor for you can be challenging.

Zoe Financial: Empower Your Financial Future

Zoe Financial empowers you to discover, interview, and hire top fiduciary advisors near you with the click of a button. Financial advisors vetted by Zoe are all fiduciary and independent.

Financial advisors in the Zoe Network are highly vetted. Just like a CFO must go through innumerable rounds of interviews to become the CEO’s right-hand person, advisors admitted into Zoe Financial’s network of true fiduciary advisors go through a stringent due diligence process that evaluates their credentials, education, and experience. Additionally, vetted advisors are unbiased and transparent, have a high ability to problem solve, and demonstrate significant operational efficiency. Zoe rejects 95% of advisors who apply to their network, so you only hire from the best!

Above all, a financial advisor can only really take on the role of your household CFO if they “get you.” Based on your unique financial situation and goals, Zoe Financial matches you with financial advisors who have successfully worked with people just like you in the past. To ensure the financial advisor can benefit their client regardless of the COVID-19 pandemic, Zoe’s extensive vetting process includes reviewing each advisor’s skills when it comes to working virtually. Only advisors who are highly qualified at meeting both virtually and safely in person are welcomed into the network. If you’re looking to discover or connect with a top fiduciary advisor in your area, learn more here.

About Zoe Financial

Zoe Financial was founded to empower you to make better financial decisions. We are a technology-driven marketplace that frictionlessly connects you with Zoe Certified Financial Advisors across the United States. Zoe’s thoughtfully curated Network of the best independent and fiduciary financial advisors and financial planners includes only the top 5% in the country. Visit zoefin.com to learn more and discover the top advisors near you.

Media Contact:

press@zoefin.com

Source: Zoe Financial