Texas Small Business Defaults on the Decline in June

Chicago, IL, August 9, 2017 (Newswire.com) - PayNet, the leading provider of credit ratings on small businesses, announces that in June 2017 the percentage of small businesses defaulting on loans has improved in Texas, with default rates in 15 of the 18 major industries falling in the state.

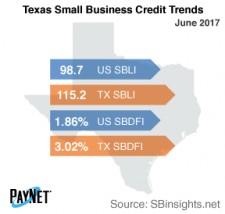

The PayNet Small Business Default Index (SBDFI) for Texas was still one of the worst in the country at 3.02% after a 13 basis point improvement from May. Texas' SBDFI was 116 basis points above the national SBDFI level of 1.86%. Financial health is weaker than a year ago in the state despite the recent downturn in defaults. Texas' SBDFI increased 21 basis points over the last year, which was a sharper upturn than the 16 basis point increase exhibited by the national SBDFI.

Transportation and Warehousing (6.75%); Mining, Quarrying, and Oil and Gas Extraction (6.32%); and Manufacturing (4.01%) exhibited the highest default rates of all industries in Texas. Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.68% compared to the prior year, while Texas had a variance of -0.49%.

Registering at 115.2, the PayNet Small Business Lending Index (SBLI) for Texas improved 0.8% from last month's state level and was 16.7% higher than this month's national SBLI level (98.7). Small business borrowers are cautiously increasing investment.

"Small business growth bodes well for future GDP," asserts William Phelan, president of PayNet.

Source: www.paynet.com