Texas Small Business Defaults Deteriorate in April

Chicago, IL, June 14, 2017 (Newswire.com) - In April 2017, more of Texas' small businesses defaulted on existing loans, with default rates in 9 of the 18 major industries rising in the state, data released by PayNet show.

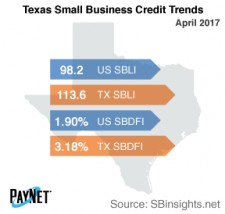

Following a 4 basis point rise from March, Texas' PayNet Small Business Default Index (SBDFI) at 3.18% trailed all states and was 128 basis points greater than the national SBDFI level of 1.90%. Over the last year, Texas' SBDFI rose 59 basis points, which was a much higher upturn than the 26 basis point increase displayed by the national SBDFI.

Mining, Quarrying, and Oil and Gas Extraction (7.26%); Transportation and Warehousing (7.18%); and Manufacturing (4.51%) exhibited the worst default rates of all industries in Texas. Nationally, Mining, Quarrying, and Oil and Gas Extraction had a default rate of 4.46%, with a change of +1.51% compared to the prior year versus a variance of +2.60% in Texas.

The PayNet Small Business Lending Index (SBLI) for Texas registered at 113.6, exceeding the national SBLI level (98.2) and performing comparably to last month's state level. Small business borrowers are cautiously considering investment.

For more information on PayNet, visit www.paynet.com.

Source: PayNet