Small Business Defaults in Wisconsin on the Rise in July

Chicago, IL, September 20, 2017 (Newswire.com) - PayNet, the leading provider of small business credit data and analysis for the commercial and industrial lending industry, announces that in July 2017 overall defaults increased within Wisconsin's small businesses. Of the 18 major industries, defaults worsened in 10 and improved in 7 in the state compared to last month.

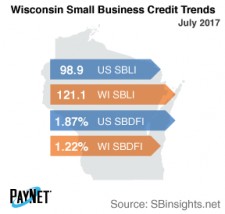

The PayNet Small Business Default Index (SBDFI) for Wisconsin was second best nationally at only 1.22% after a 3 basis point increase from June. Compared to the national SBDFI level of 1.87%, Wisconsin's SBDFI was 65 basis points less. The uptick in defaults over the past six months may signal weakening financial health in the state. Year-over-year, the national SBDFI increased 15 basis points, while Wisconsin's SBDFI increased 1 basis points.

Transportation and Warehousing (3.42%); Agriculture, Forestry, Fishing and Hunting (2.22%); and Professional, Scientific, and Technical Services (1.86%) displayed the worst default rates of all industries in Wisconsin. Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.63% compared to the prior year, while Wisconsin had a variance of -0.58%.

At 121.1, Wisconsin's PayNet Small Business Lending Index (SBLI) ranked 3rd in the country, performing comparable to last month's state level and was 22.4% greater than the national SBLI level of 98.9 this month.

"More definitive trends are needed to gauge the future economic performance for Wisconsin," states William Phelan, president of PayNet.

Source: www.paynet.com