Small Business Defaults in Washington Down in May

Chicago, IL, July 25, 2017 (Newswire.com) - In May 2017, fewer Washington small businesses defaulted on existing loans, according to data released by PayNet. However, of the 18 major industries, only 8 declined in the state.

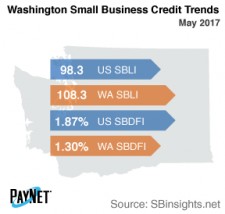

PayNet’s Small Business Default Index (SBDFI) for Washington registered at 1.30% after a 3 basis point reduction from April. Washington's SBDFI was 57 basis points below the national SBDFI level of 1.87%. Despite the favorable improvement last month, the index is basically unchanged from a year ago. Year-over-year, the national SBDFI rose 19 basis points, whereas Washington's SBDFI fell 2 basis points.

Transportation and Warehousing (2.97%); Information (2.00%); and Accommodation and Food Services (1.99%) recorded the highest default rates of all industries in Washington. Nationally, Transportation and Warehousing had a default rate of 4.59%, with a difference of +0.99% compared to the prior year, while Washington had a variance of +0.57%.

At 108.3, the PayNet Small Business Lending Index (SBLI) for Washington surpassed the national SBLI level (98.3) despite declining by 0.6% from the previous month's state level.

"More definitive trends are needed to gauge the future economic performance for Washington," states the president of PayNet, William Phelan.

Source: www.paynet.com