Small Business Defaults in Texas on the Decline in March

Chicago, IL, May 10, 2017 (Newswire.com) - PayNet, the premier provider of small business credit data and analysis for the commercial and industrial lending industry, reports that in March 2017 the percentage of Texas' small businesses defaulting on existing loans has declined, with default rates in 12 of the 18 major industries falling in the state.

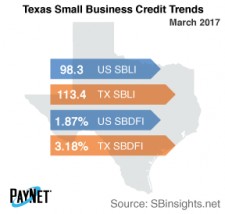

PayNet’s Small Business Default Index (SBDFI) for Texas trailed all states at 3.18% following a 4 basis point improvement from February. Texas' SBDFI was 131 basis points greater than the national SBDFI level of 1.87%. The decline in defaults over the past three months may signal improving financial health in the state. Texas' SBDFI rose 73 basis points year-over-year, which was a significantly sharper climb than the 25 basis point increase displayed by the national SBDFI.

Transportation and Warehousing (7.36%); Mining, Quarrying, and Oil and Gas Extraction (6.65%); and Manufacturing (4.55%) exhibited the worst default rates of all industries in Texas. Nationally, Transportation and Warehousing had a default rate of 4.49%, with a difference of +1.24% compared to the prior year variance of +1.14% in Texas.

At 113.4, the PayNet Small Business Lending Index (SBLI) for Texas rose 0.4% from the previous month's state level and was 15.4% above the national SBLI level of 98.3 this month. Year-over-year, business investment deteriorated 7.0%, reducing future growth potential.

"The performance of defaults over recent months may foster a better lending environment," states the president of PayNet, William Phelan.

Source: www.paynet.com