Small Business Defaults in Pennsylvania on the Decline in June

Chicago, IL, August 9, 2017 (Newswire.com) - In June 2017, the percentage of small businesses defaulting on loans has improved in Pennsylvania, according to data released by PayNet. Of the 18 major industries, 15 improved and only 2 worsened in the state.

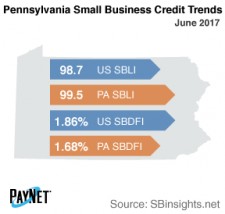

Following a 4 basis point decline from May, Pennsylvania's PayNet Small Business Default Index (SBDFI) at 1.68% was 18 basis points less than the national SBDFI level of 1.86%. Financial health is weaker than a year ago in the state despite the recent downturn in defaults. Over the last year, the national SBDFI increased 16 basis points, while Pennsylvania's SBDFI increased 13 basis points.

Transportation and Warehousing (3.48%); Mining, Quarrying, and Oil and Gas Extraction (3.24%); and Manufacturing (2.30%) exhibited the highest default rates of all industries in Pennsylvania. Nationally, Transportation and Warehousing had a default rate of 4.57%, with an increase of 0.68% compared to the prior year, while Pennsylvania declined 0.09%.

Pennsylvania's PayNet Small Business Lending Index (SBLI) was 99.5, performing similarly to both last month's level and this month's national SBLI level (98.7). Small business borrowers are being cautious and holding off on new investment.

"Weaker financial health and investment by small businesses reflect caution regarding future demand," asserts the president of PayNet, William Phelan.

Source: www.paynet.com