Small Business Defaults in New Mexico Up in April

Chicago, IL, June 14, 2017 (Newswire.com) - In April 2017, a greater number small businesses defaulted on loans in New Mexico, according to data announced by PayNet. Of the 18 major industries, 13 increased and 5 dropped in the state.

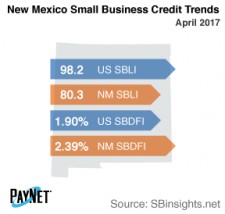

After a 3 basis point climb from March, New Mexico's PayNet Small Business Default Index (SBDFI) of 2.39% was 49 basis points higher than the national SBDFI level of 1.90%. The consistently unfavorable trend in default rates over the past year signals heightened financial stress in the state. Year-over-year, New Mexico's SBDFI rose 43 basis points, while the national SBDFI rose 26 basis points.

The industries with the highest default rate in New Mexico were Mining, Quarrying, and Oil and Gas Extraction (6.47%); Transportation and Warehousing (5.46%); and Construction (3.02%). Nationally, Mining, Quarrying, and Oil and Gas Extraction had a default rate of 4.46%, with a change of +1.51% compared to the prior year versus a variance of +2.48% in New Mexico.

Registering at 80.3, New Mexico's PayNet Small Business Lending Index (SBLI) dropped 0.4% from the previous month's state level and was 18.2% beneath the national SBLI level (98.2) this month.

"More definitive trends are needed to gauge the future economic performance for New Mexico," explains the president of PayNet, William Phelan.

For more information on PayNet, visit www.paynet.com.

Source: PayNet