Small Business Defaults in Georgia Up in September

Atlanta, GA, November 21, 2017 (Newswire.com) - PayNet, the leading provider of small business credit assessments on private companies, reports that in September 2017 the percentage of Georgia's small businesses defaulting on existing loans has increased. However, of the 18 major industries, 10 dropped in the state compared to the prior month.

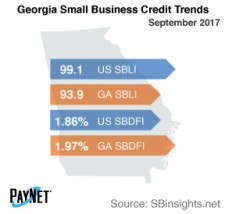

After a 2 basis point increase from August, Georgia's PayNet Small Business Default Index (SBDFI) at 1.97% was 11 basis points above the national SBDFI level of 1.86%. Financial health is stronger than a year ago in the state despite the recent uptick in defaults. The national SBDFI rose 7 basis points year-over-year, whereas Georgia's SBDFI declined 13 basis points.

Slower borrowing and investment by small businesses means lower GDP in the next quarter.

William Phelan, President

Information (5.36%); Transportation and Warehousing (4.97%); and Retail Trade (3.52%) registered the highest default rates of all industries in Georgia. Nationally, Information had a default rate of 2.85%, with a difference of +0.50% compared to the prior year, while Georgia had a variance of +2.93%.

Georgia's PayNet Small Business Lending Index (SBLI) registered at 93.9, declining 0.8% from the previous month's state level, but 5.2% below this month's national SBLI level (99.1). Small business borrowers are being cautious and holding off on new investment.

"Slower borrowing and investment by small businesses means lower GDP in the next quarter," explains William Phelan, president of PayNet.

Source: www.paynet.com