Small Business Defaults in Florida Up in July

Chicago, IL, September 20, 2017 (Newswire.com) - PayNet, the leading provider of small business credit assessments on private companies, announces that in July 2017 the percentage of Florida's small businesses defaulting on existing loans has risen. Of the 18 major industries, defaults rose in 11 and fell in 7 in the state compared to the previous month.

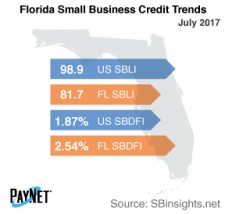

The PayNet Small Business Default Index (SBDFI) for Florida was one of the worst in the country at 2.54% following a 7 basis point rise from June. Florida's SBDFI was 67 basis points higher than the national SBDFI level of 1.87%. Florida's SBDFI increased 37 basis points over the last year, while the national SBDFI rose 15 basis points.

The industries with the highest default rates in Florida were Transportation and Warehousing (5.83%); Professional, Scientific, and Technical Services (3.49%); and Health Care and Social Assistance (3.19%). Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.63% compared to the prior year, while Florida had a variance of -0.47%.

At 81.7, Florida's PayNet Small Business Lending Index (SBLI) increased 0.4% from last month's state level, but was 17.4% lower than the national SBLI level of 98.9 this month. Small business borrowers are cautiously increasing investment.

"Time will tell how these conditions will affect Florida's economy going forward," states William Phelan, president of PayNet.

Source: www.paynet.com