Small Business Defaults in Florida on the Decline in June - PayNet

Chicago, IL, August 9, 2017 (Newswire.com) - In June 2017, the percentage of small businesses defaulting on loans has improved in Florida, according to data announced by PayNet. Of the 18 major industries, 10 dropped and 6 rose in the state.

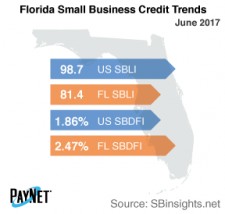

The PayNet Small Business Default Index (SBDFI) for Florida at 2.47% after a 6 basis point reduction from May. Florida's SBDFI was 61 basis points above the national SBDFI level of 1.86%. The decline in defaults over the past three months may signal better business conditions in the state. Over the last year, Florida's SBDFI rose 40 basis points, which was a much sharper rise than the 16 basis point increase displayed by the national SBDFI.

The three industries with the highest default rates in Florida were Transportation and Warehousing (6.09%); Professional, Scientific, and Technical Services (3.36%); and Health Care and Social Assistance (2.96%). Nationally, Transportation and Warehousing had a default rate of 4.57%, with a difference of +0.68% compared to the prior year, while Florida had a variance of +0.07%.

At 81.4, the PayNet Small Business Lending Index (SBLI) for Florida rose 0.1% from the previous month's state level, but was 17.5% lower than this month's national SBLI level (98.7). The Index is basically unchanged from a year ago.

"It appears the economy is improving and will soon be able to resume expansion," asserts William Phelan, president of PayNet.

Source: www.paynet.com