Small Business Defaults in Colorado on the Decline in November

Chicago, IL, January 24, 2018 (Newswire.com) - PayNet, the premier provider of small business credit assessments on private companies, reports that in November 2017 fewer of Colorado's small businesses defaulted on existing loans, with default rates in 13 of the 18 major industries falling in the state.

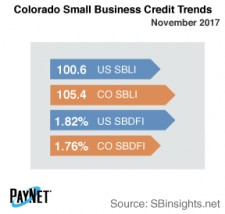

After a 6 basis point drop from October, Colorado's PayNet Small Business Default Index (SBDFI) at 1.76% was 6 basis points less than the national SBDFI level of 1.82%. The decline in defaults over the past three months may signal improving financial health in the state. The national SBDFI dipped 1 basis point over the last year, while Colorado's SBDFI fell 19 basis points.

The industries with the worst default rates in Colorado were Mining, Quarrying, and Oil and Gas Extraction (3.96%); Transportation and Warehousing (3.19%); and Information (2.86%). Nationally, Mining, Quarrying, and Oil and Gas Extraction had a default rate of 2.94%, with a difference of -1.73% compared to the prior year, while Colorado had a variance of -2.35%.

The PayNet Small Business Lending Index (SBLI) for Colorado registered at 105.4, surpassing the national SBLI level (100.6) and performing on par with the previous month's state level. Small business borrowers are cautiously increasing investment.

"Recent investment and improved financial health exhibited by Colorado's small businesses set the stage for expansion with low credit risk," explains the president of PayNet, William Phelan.

Source: PayNet