Small Business Borrowing in Wisconsin Stalls in September

Madison, Wisconsin, November 21, 2017 (Newswire.com) - In September 2017, Wisconsin's small firms borrowed comparably to last month, data released by PayNet shows. Of the 18 major industries, 8 rose and 10 descended in Wisconsin.

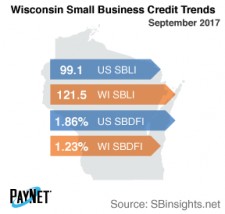

Wisconsin ranked 3rd in the country with their PayNet Small Business Lending Index (SBLI) of 121.5, which performed on par with the previous month's state level and was 22.6% higher than this month's national SBLI level (99.1).

More definitive trends are needed to gauge the future economic performance for Wisconsin.

William Phelan, President

The three industries with the most favorable change in lending activity over the past year in Wisconsin were Mining, Quarrying, and Oil and Gas Extraction (40.5%); Arts, Entertainment, and Recreation (34.5%); and Accommodation and Food Services (26.0%). As well as having the second-greatest improvement this month, Arts, Entertainment, and Recreation also recorded the highest lending activity (439.8) of all industries in Wisconsin.

At only 1.23%, the PayNet Small Business Default Index (SBDFI) for Wisconsin ranked 2nd best nationally and was 63 basis points below the national SBDFI level of 1.86% after a similar value to August. Compared to last year, the national SBDFI rose 7 basis points, whereas Wisconsin's SBDFI improved 4 basis points.

"More definitive trends are needed to gauge the future economic performance for Wisconsin," states William Phelan, president of PayNet.

Source: www.paynet.com