Small Business Borrowing in Pennsylvania Stalls in December

Harrisburg, PA, February 28, 2018 (Newswire.com) - PayNet, the leading provider of credit ratings on small businesses, announces that in December 2017 Pennsylvania's small firms borrowed similarly to the previous month. Of the 18 major industries, 7 increased and 11 declined in Pennsylvania.

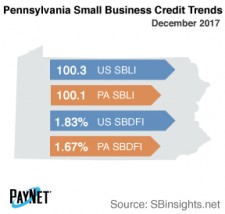

The PayNet Small Business Lending Index (SBLI) for Pennsylvania came in at 100.1, performing similarly to both the previous month's state level and this month's national SBLI level (100.3). The index is basically unchanged from a year ago.

Retail Trade (-10.6%); Information (-7.5%); and Other Services (-5.8%) were the industries with the largest drop in lending activity over the past year in Pennsylvania. In addition to having the second greatest decline in lending activity, Information recorded the lowest value (52.6).

The PayNet Small Business Default Index (SBDFI) for Pennsylvania stood at 1.67%. After a similar value to last month, Pennsylvania's SBDFI was 16 basis points less than the national SBDFI level of 1.83%. Year-over-year, the national SBDFI has held steady, whereas Pennsylvania's SBDFI improved 8 basis points.

"Time will tell how these conditions will affect Pennsylvania's economy going forward," asserts the president of PayNet, William Phelan.

Source: PayNet