Small Business Borrowing in New Jersey Falls in April

Chicago, IL, June 13, 2017 (Newswire.com) - In April 2017, New Jersey's small firms borrowed less, data released by PayNet indicates. Of the 18 major industries, 11 dropped and 6 showed gains in New Jersey.

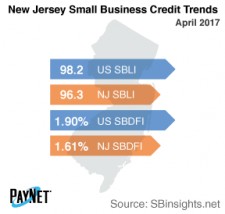

The PayNet Small Business Lending Index (SBLI) for New Jersey came in at 96.3, falling 1.3% from last month's level and 1.9% below this month's national SBLI level (98.2). Small business borrowers are behaving more cautiously by reducing investment.

Real Estate and Rental and Leasing (-20.3%); Public Administration (-13.7%); and Admin & Support and Waste Management & Remediation Services (-12.3%) were the industries with the largest drop in lending activity over the past year in New Jersey. Nationally, Real Estate and Rental and Leasing fell by -1.9% year over year.

The PayNet Small Business Default Index (SBDFI) for New Jersey stood at 1.61%. After a comparable value to the previous month, New Jersey's SBDFI was 29 basis points below the national SBDFI level of 1.90%. The national SBDFI climbed 26 basis points year-over-year, whereas New Jersey's SBDFI dipped 5.

"Time will tell how these conditions will affect New Jersey's economy going forward," explains the president of PayNet, William Phelan.

Source: PayNet