Small Business Borrowing in Massachusetts Stalls in January

Boston, MA, March 15, 2018 (Newswire.com) - PayNet, the leading provider of small business credit data and analysis for the commercial and industrial lending industry, reports that in January 2018 borrowing is sluggish in Massachusetts. Of the 18 major industries, 6 increased and 12 declined in Massachusetts.

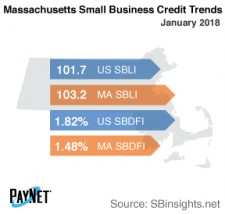

At 103.2, Massachusetts' PayNet Small Business Lending Index (SBLI) exceeded the national SBLI level (101.7) and performed comparably to last month's state level. The index is basically unchanged from a year ago.

The three industries with the greatest decline in lending activity over the past year in Massachusetts were Real Estate and Rental and Leasing (-14.8%); Mining, Quarrying, and Oil and Gas Extraction (-13.3%); and Information (-12.8%). Nationally, Real Estate and Rental and Leasing fell by -1.7% year over year.

Following a similar performance to last month, Massachusetts' PayNet Small Business Default Index (SBDFI) of 1.48% was 34 basis points less than the national SBDFI level of 1.82%. Massachusetts' SBDFI rose 37 basis points year-over-year, whereas the national SBDFI dipped 2.

"Time will tell how these conditions will affect Massachusetts's economy going forward," asserts William Phelan, president of PayNet.

Source: PayNet