Small Business Borrowing in Florida Stalls in April

Chicago, IL, June 9, 2017 (Newswire.com) - PayNet, the premier provider of small business credit assessments on private companies, reports that in April 2017 Florida's small firms borrowed on par with the previous month. Of the 18 major industries, 7 rose and 11 dropped in Florida.

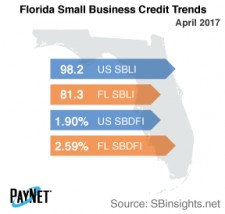

The PayNet Small Business Lending Index (SBLI) for Florida came in at 81.3, performing similarly to the previous month's level, but 17.2% below the national SBLI level (98.2) this month. The index is basically unchanged from a year ago.

Transportation and Warehousing (-15.3%); Finance and Insurance (-15.2%); and Health Care and Social Assistance (-14.0%) were the industries with the largest drop in lending activity over the past year in Florida. Nationally, Transportation and Warehousing fell by -14.4% year over year.

After a comparable performance to last month, Florida's PayNet Small Business Default Index (SBDFI) at 2.59% was 69 basis points greater than the national SBDFI level of 1.90%. Year-over-year, Florida's SBDFI rose 66 basis points, while the national SBDFI increased 26.

"This all means less risk taking and stabilizing credit quality of small businesses," states the president of PayNet, William Phelan.

Source: www.paynet.com