Pennsylvania Small Business Defaults Increasing in September

Harrisburg, Pennsylvania, November 21, 2017 (Newswire.com) - PayNet, the premier provider of small business credit data and analysis for the commercial and industrial lending industry, announces that in September 2017 the percentage of small businesses defaulting on loans has increased in Pennsylvania. However, of the 18 major industries, 14 improved in the state compared to the previous month.

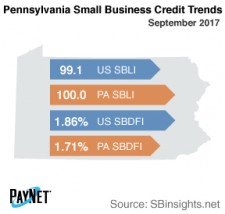

The PayNet Small Business Default Index (SBDFI) for Pennsylvania registered at 1.71% following a 4 basis point rise from August. Compared to the national SBDFI level of 1.86%, Pennsylvania's SBDFI was 15 basis points lower. Despite the unfavorable uptick last month, the index is basically unchanged from a year ago. Year-over-year, the national SBDFI rose 7 basis points, while Pennsylvania's SBDFI has remained flat.

Transportation and Warehousing (3.41%); Mining, Quarrying, and Oil and Gas Extraction (2.74%); and Accommodation and Food Services (2.45%) exhibited the highest default rates of all industries in Pennsylvania. Nationally, Transportation and Warehousing had a default rate of 4.43%, with a difference of +0.35% compared to the prior year, while Pennsylvania had a variance of -0.23%.

At 100, the PayNet Small Business Lending Index (SBLI) for Pennsylvania improved 0.4% from last month's state level and performed comparably to the national SBLI level of 99.1 this month. "Small businesses are back in the game and investing again," states William Phelan, president of PayNet.

Source: www.paynet.com