Payer IT Vendors Enter 'AI Gold Rush' as Health Plans Race to Build Infrastructure for Trusted Automation, Black Book Survey

Seventy-nine Percent of Health Plans Remain Unprepared for Scaled AI as Record Investments Signal a Tipping Point for Payer IT Modernization

TAMPA, FL, May 22, 2025 (Newswire.com) - As artificial intelligence continues to reshape healthcare operations, a new survey by independent research firm Black Book Research reveals that while many U.S. health plans are still building the necessary infrastructure for enterprise-wide AI adoption, significant progress is underway. According to the Q3 2024-Q2 2025 survey of 1,142 payer IT and operations leaders, 79% report their organizations are actively enhancing their technological capabilities to support large-scale AI deployment.

Encouragingly, 70% of respondents indicated that modernization initiatives are in progress, backed by strong executive-level support for AI-driven innovation in areas such as claims automation, utilization management, risk modeling, and member engagement. Health plans are increasingly prioritizing infrastructure upgrades and data interoperability to prepare for a more intelligent, automated future.

"This is not a story of resistance but rather one of readiness," said Doug Brown, Founder of Black Book Research. "AI adoption in payer IT is accelerating, but successful implementation requires a robust digital backbone. Health plans recognize this and are making strategic investments to transform promise into performance."

Key Findings from the 2025 Payer IT Readiness Survey:

79% of payer IT leaders report they are actively building the infrastructure needed for enterprise-level AI implementation.

67% have initiatives underway to modernize legacy claims and care management platforms to enable intelligent automation.

58% are exploring AI pilots in targeted areas such as pre-authorizations, coding accuracy, and fraud detection, with promising early results.

85% of respondents say AI adoption has become a board-level strategic priority, up from just 19% in Q1 2023.

72% report increasing collaboration between IT, clinical, and financial teams to ensure AI investments align with organizational goals.

From Challenge to Opportunity: Laying the Groundwork for AI Transformation

While legacy systems remain a hurdle, the survey reveals a shift in mindset across health plans. Many are transitioning from fragmented, batch-based systems to cloud-native, API-driven platforms that allow AI tools to access data in real time. AI-powered solutions for prior authorization, for example, show early success in reducing administrative burdens and turnaround times, but integration remains key.

Health plans are also focusing on breaking down internal data silos that limit AI's effectiveness. Modernization projects are targeting unified data lakes, scalable compute environments, and open interoperability frameworks to prepare for broader AI rollouts. Respondents emphasized the need for transparency and measurable value from vendors, urging a move beyond "AI-washing" toward truly intelligent, adaptive tools.

A Payer IT Gold Rush Ignites

A full-scale infrastructure investment wave is underway. Health plan technology budgets are projected to grow by over 12% in 2025, with total infrastructure spending expected to reach tens of billions of dollars over the next 24 months. As new clinical and administrative AI use cases move from pilot to production, payer organizations are racing to procure and integrate trusted platforms, cloud environments, AI-ready software, and modular service layers at unprecedented speed.

"This surge marks a true AI gold rush, as health plans vie for the capabilities required to support trustworthy, scalable, and real-time artificial intelligence across their operations. Payer IT vendors offering validated solutions, integration expertise, and measurable ROI are experiencing a sharp uptick in demand and long-term strategic engagements," said Doug Brown, Founder of Black Book.

Modern Payer Core Systems & Legacy Optimization

As health plans accelerate digital transformation, modernizing core administrative infrastructure is foundational. While legacy systems still handle high-volume functions like claims and enrollment, leading vendors now offer hybrid modernization paths, bridging historical reliability with AI readiness and cloud scalability.

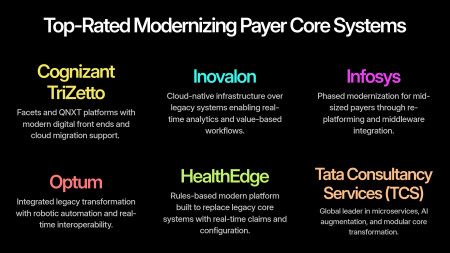

Top Core Infrastructure Vendors:

Cognizant TriZetto - Facets and QNXT platforms with modern digital front ends and cloud migration support.

Inovalon - Cloud-native infrastructure over legacy systems enabling real-time analytics and value-based workflows.

Infosys - Phased modernization for mid-sized payers through re-platforming and middleware integration.

Optum - Integrated legacy transformation with robotic automation and real-time interoperability.

HealthEdge - Rules-based modern platform built to replace legacy core systems with real-time claims and configuration.

Tata Consultancy Services (TCS) - Global leader in microservices, AI augmentation, and modular core transformation.

"These vendors enable payers to retain mission-critical legacy functionality while building toward a digitally agile future," said Brown. "With modernization no longer an all-or-nothing decision, successful infrastructure strategies now focus on incremental transformation, interoperability bridging, and AI-enablement."

Top-Rated Vendors Powering the Payer Infrastructure Shift

Black Book's 2025 client satisfaction surveys highlight these top-rated vendors transforming payer infrastructure across key IT categories:

Cloud-Based Data Platforms

Top Vendor: Inovalon - Industry-leading data lake and compute infrastructure designed for payer AI scale.

Claims & Administration Platforms

Top Vendor: Optum - End-to-end automation with strong integration across core financial and care systems.

Payer Analytics & Quality Management

Top Vendor: Veradigm - Seamless clinical/claims integration with robust population-level analytics.

Care Management & Coordination

Top Vendor: VirtualHealth (HELIOS) - Agile platform for Medicaid, Medicare Advantage, and chronic care populations.

Provider Data Management

Top Vendor: InterSystems - Supports large-scale directory accuracy and provider network operations.

Cybersecurity & Compliance

Top Vendors:

Palo Alto Networks - AI-powered infrastructure and cloud defense.

Symplr - Credentialing, regulatory compliance, and workforce risk oversight.

AI-Driven Population Health Management

Top Vendor: Innovaccer - Unified data activation platform with predictive tools and SDoH integration.

Outsourced IT Infrastructure & Digital Transformation

Top Vendors:

Accenture - Full-scale AI implementation, cloud transition, and strategic advisory.

Tata Consultancy Services (TCS) - Enterprise-scale modernization, automation, and infrastructure management.

"As health plans move from exploration to execution, vendor partnerships with proven track records and interoperable, scalable platforms are becoming the decisive advantage in the race toward intelligent, responsive payer operations," added Brown.

Top-Rated Consulting Firms for Payer Digital Transformation & Infrastructure Advisory

Payers are increasingly turning to consulting and advisory firms to navigate the complexity of AI-driven digital transformation, as 64% report lacking internal expertise to modernize legacy infrastructure and implement scalable, trusted AI systems. With over 72% of health plans now prioritizing infrastructure upgrades as part of their enterprise strategy, external consultants are playing a critical role in accelerating technology adoption, aligning IT with business goals, and managing vendor ecosystems.

Deloitte

Client-Rated Strengths: Digital core transformation, cloud-native infrastructure, SDoH strategy, cybersecurity, and analytics consulting. A top performer in payer strategy and risk-based payment transformation with Enterprise payer platforms integrating CRM, ERP, and AI data hubs; large Medicaid and Medicare Advantage IT redesigns.

Infosys

Client-Rated Strengths: Digital core consulting, data strategy, and payer platform integration. Frequently engaged in mid-market payer transformations; well-regarded for agile migration methodologies. FHIR and interoperability infrastructure development, hybrid cloud deployments for national and regional plans.

Capgemini

Client-Rated Strengths: Data and AI strategy for health plans, cloud services, and large-scale systems integration.Known for its payer-specific digital transformation playbooks and FHIR implementation capabilities for Commercial payers and national plan consortiums.

About Black Book Research

Since 2004, Black Book Research has been the industry's leading source of unbiased insights into payer and health plan IT, outsourcing, and digital transformation. With no vendor sponsorship or influence, Black Book surveys focus on payer-specific KPIs, including client experience, satisfaction, ROI, innovation, and support. Over the past two decades, more than 200,000 verified users of payer IT systems and services have contributed to Black Book's crowd-sourced evaluations, making it the most comprehensive and independent database of health plan technology performance in the market.

Contact Information:

Press Office

research@blackbookmarketresearch.com

8008637590

Source: Black Book Research