New Jersey Small Business Defaults Increasing in February

Chicago, IL, April 13, 2017 (Newswire.com) - PayNet, the leading provider of small business credit data and analysis for the commercial and industrial lending industry, reports that in February 2017 the percentage of New Jersey's small businesses defaulting on existing loans has risen. Of the 18 major industries, defaults worsened in 11 and improved in 6 in the state compared to the prior month.

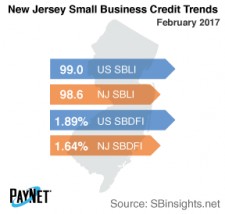

The PayNet Small Business Default Index (SBDFI) for New Jersey stood at 1.64% after a 5 basis point increase from January. Compared to the national SBDFI level of 1.89%, New Jersey's SBDFI was 25 basis points lower. Financial health is stronger than a year ago in the state despite the recent uptick in defaults. Over the last year, the national SBDFI increased 30 basis points, whereas New Jersey's SBDFI declined 6 basis points.

Transportation and Warehousing (3.21%); Agriculture, Forestry, Fishing and Hunting (2.03%); and Construction (2.01%) registered the worst default rates of all industries in New Jersey. Nationally, Transportation and Warehousing had a default rate of 4.44%, with a difference of +1.31% compared to the prior year variance of +0.49% in New Jersey.

Coming in at 98.6, New Jersey's PayNet Small Business Lending Index (SBLI) fell 0.4% from the previous month's state level, but still performed on par with the national SBLI level of 99.0 this month. The Index is basically unchanged from a year ago.

"Increased defaults combined with restrained borrowing signals a more pessimist view of economic prospects," states the president of PayNet, William Phelan.

Source: PayNet