Massachusetts Small Business Defaults Deteriorate in September

Boston, MA, November 21, 2017 (Newswire.com) - In September 2017, the percentage of Massachusetts' small businesses defaulting on existing loans has risen, according to data published by PayNet. Of the 18 major industries, 11 increased and 5 fell in the state.

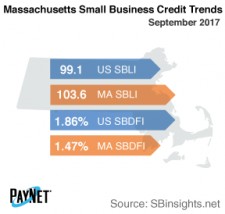

The PayNet Small Business Default Index (SBDFI) for Massachusetts registered at 1.47% after a 5 basis point rise from August. Massachusetts' SBDFI was 39 basis points less than the national SBDFI level of 1.86%. Rising default rates over the past year signals heightened financial stress in the state. Year-over-year, Massachusetts' SBDFI increased 41 basis points, which was a much sharper upturn than the 7 basis point increase displayed by the national SBDFI.

Expansion has been stagnant over the past year, but conditions may have turned around with the recent increase in lending and modest default rate.

William Phelan, President

The industries with the worst default rates in Massachusetts were Manufacturing (2.63%); Public Administration (2.57%); and Information (2.43%). Nationally, Manufacturing had a default rate of 1.95%, with a difference of +0.18% compared to the prior year, while Massachusetts had a variance of +1.34%.

Massachusetts' PayNet Small Business Lending Index (SBLI) registered at 103.6, exceeding the national SBLI level (99.1) and performing on par with the previous month's state level. The Index is basically unchanged from a year ago.

"Expansion has been stagnant over the past year, but conditions may have turned around with the recent increase in lending and modest default rate," asserts the president of PayNet, William Phelan.

Source: www.paynet.com