Massachusetts Small Business Defaults Deteriorate in July

Chicago, IL, September 20, 2017 (Newswire.com) - PayNet, the leading provider of small business credit data and analysis for the commercial and industrial lending industry, announces that in July 2017 the percentage of Massachusetts' small businesses defaulting on existing loans has increased. Of the 18 major industries, defaults worsened in 10 and improved in 8 in the state compared to last month.

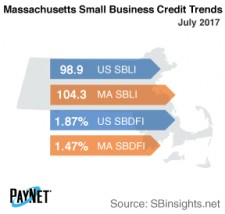

Despite an 11 basis point rise from June, Massachusetts' PayNet Small Business Default Index (SBDFI) at 1.47% was still 40 basis points under the national SBDFI level of 1.87%. The consistently unfavorable trend in default rates over the past year signals heightened financial stress in the state. Year-over-year, Massachusetts' SBDFI increased 33 basis points, which was a significantly higher rise than the 15 basis point increase exhibited by the national SBDFI.

The three industries with the highest default rates in Massachusetts were Manufacturing (2.59%); Information (2.07%); and Transportation and Warehousing (1.97%). Nationally, Manufacturing had a default rate of 1.97%, with a difference of +0.29% compared to the prior year, while Massachusetts had a variance of +1.13%.

The PayNet Small Business Lending Index (SBLI) for Massachusetts registered at 104.3, surpassing the national SBLI level (98.9) despite falling by 0.5% from last month's state level. The Index is basically unchanged from a year ago.

"Declining credit quality could potentially hinder future investment," explains William Phelan, president of PayNet.

Source: www.paynet.com