IDTechEx Research Asks if the Graphene Competitive Landscape Will Be Drastically Reconfigured

The new IDTechEx Research report 'Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029' offers a detailed analysis of the technological and commercial progress as well prospects of graphene, carbon nanotubes and non-graphene 2D materials.

BOSTON, May 7, 2019 (Newswire.com) - These are interesting times for graphene. Multiple significant applications have arrived in the market. Revenues are growing for many and companies are finally seeing average order sizes grow thanks to a few high volume (multi-tonne) lead conversions. This looks like the first stage of the growth phase.

In their new report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029, IDTechEx Research forecast that the industry will reach its inflection point between 2021-2022. Despite all of these positive signs, the industry remains loss-making and many firms seem to be on a weak footing. Indeed, the signs are that the competitive landscape is poised for a period of change and realignment. The below outlines some broad ideas but for details please refer to www.IDTechEx.com/graphene.

At some point, especially during the 2010-2013 period, the number of graphene companies mushroomed. These firms were mostly positioned as suppliers. The rate of company formation then slowed, although recently IDTechEx sense that a new wave is being formed with focus on graphene applications and not production.

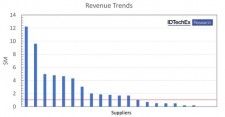

Almost all firms were and are in the negative. Most have very small revenues (see below). Many survive thanks to direct to indirect research grants and subsidies. IDTechEx has often argued that this is an unsustainable situation. And many firms have quietly already left the scene (IDTechEx can easily count more than 12 already and know of several whose finances are strained). Some have been acquired by larger and more capable firms. These processes are likely to only accelerate.

Today some volume applications and revenue leaders are being established. These firms are erecting a growing competence gap and barrier between themselves and others. As a result, the business map is beginning to consist of three tiers of non-start-up companies: (1) those who are resource-constrained and thus poorly placed to capture the growth phase; (2) those who have some capacity, strong know-how, and a long customer list, but are not yet leaders; and (3) leaders who have the largest technical and commercial know-how as well as capacity and revenue.

IDTechEx thinks many in category one will not survive for long, as outlined in Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029. Subsidies, old contracts, and local advantage might keep some ticking along, but even then they would likely remain a semi-permanent start-up. Those in category two are in an unsustainable position. The landscape is shifting, and leading edge of the industry is leaving them behind. They face difficult and risky business and investment choices to avert their demise. IDTechEx thinks they have a narrow window for significant action (2-4 years) and no easy options.

The third category is the emerging leaders. They have a competitive advantage in one or multiple fronts. They have accumulated commercial know-how and large installed capacity with reasonably consistent production quality. They have secured first rounds of large orders, reflecting customer faith in their technology and in their ability to supply graphene consistently at high volume and reasonable price. The competition between these firms is shifting towards cost and volume. Still they differentiate by the properties of their materials and by the target markets; increasingly they will be pushed towards competition in terms of operation effectiveness. Some amongst them are taking additional capital risk to invest in larger capacities, hoping to (a) open-up serious discussions in markets where volume is critical; and (2) to dramatically raise their scale and cut their cost in order to force others out, which will consolidate the market. The latter will be difficult to achieve given that graphene has a speciality chemical character and is not really one material serving one market. Indeed, no two graphene are identical, and this will keep the market somewhat fragmented with companies positioning at different price-performance benefit points.

There are also early stage start-ups. On the production side, they either claim to have a technology to produce graphene at higher yields (often with reduced waste and energy consumption) and/or a technology that produces the so-called “true graphene.” Many of their innovations look like incremental improvements and are not disruptive. But this is not to say that they are not important innovations, for example increasing graphene concentration and cutting production time are key development directions. These new players are facing a market that is already somewhat established. This is different from the situation of 7-8 years ago when many were acting though it was the wild west. They must take the time to learn the lessons of the industry and choose their positioning with care otherwise they will easily become a copycat firm easily dismissed. These players must be very thorough in their strategic market segmentation and quickly find their focus, otherwise they will waste their limited resources trying to please everyone and thus pleasing no one.

In general, the business landscape is beginning to reconfigure itself. The leaders are emerging, increasing their capacity, revenue, and technical and commercial know-how distance with the rest of the pack. Many others face uneasy choices about what to do next. They cannot afford to lose little time. As always, fantastic opportunities will emerge in times of change. The situation is therefore worth being closely watched.

To follow this industry please consult Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029. This report from IDTechEx Research offers a detailed analysis of the technological and commercial progress of graphene, carbon nanotubes and non-graphene 2D materials. It is the result of years of ongoing research since 2011/ 2012.

For more information contact research@IDTechEx.com or visit www.IDTechEx.com/graphene.

IDTechEx guides your strategic business decisions through its Research, Consultancy and Events services, helping you profit from emerging technologies. Find out more at www.IDTechEx.com.

Media Contact:

Charlotte Martin

Marketing & Research Co-ordinator

c.martin@IDTechEx.com

+44(0)1223 812300

Source: IDTechEx