Global Market Report From IDTechEx Research on OLED Display Forecasts and Technologies 2019-2029: The Global Rise of Flexible and Foldable Displays

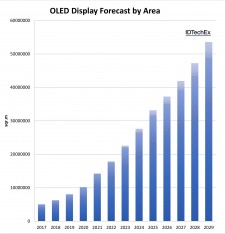

BOSTON, February 5, 2019 (Newswire.com) - OLED Display Forecasts and Technologies 2019-2029: The Global Rise of Flexible and Foldable Displays from IDTechEx Research includes technology analysis and detailed forecasts by market segment and display type, with additional assessment of Quantum Dot Displays, E-Paper Displays and other Flexible Displays. The report provides a comprehensive assessment of OLED display technologies and markets in addition to the progress with other emerging display technologies including quantum dots and electrophoretic displays.

Analysis and Forecasts of OLED Markets to 2029

Detailed trends, supplier information and market forecasts are provided on a global basis for the following applications of OLED displays:

· Cellphones

· Tablet and Computers

· TV

· Automotive

· Wearable

· Industrial and Professional Equipment

· MICRO OLED

· Other: Gaming Consoles, Cameras, Appliances, Other Consumer Electronics

For each of the above, the market size is provided for the years 2017-2029 in addition to total display area in sq meters.

Additionally, data is broken out by form factor for the following categories:

· Glass based OLED displays

· Flexible / Rigid plastic based OLED displays

· Flexible / Foldable OLED displays

The data and forecasts given are the result of extensive research including interviews with key providers of OLED materials, manufacturing equipment, panel makers and OEMs. For each of the applications above IDTechEx provides detailed assessments of the markets including the technology requirements, technology roadmap and the impact of competitive technologies, which all feed in to the forecasting model.

In 2018, the OLED industry will be worth $25.5Bn, rising to $30.3Bn in 2019. Over $15Bn has been invested in the OLED display industry from 2016 to 2018 with panel makers mainly based in China, Korea, Japan and Taiwan. The investment is coming from the need to differentiate products with better screens and new form factors, with plastic based OLEDs becoming the norm (in rigid format) leading to truly flexible OLED displays - foldable displays being the first commercial example of that, expected in 2019.

OLEDs for cellphones dominate the OLED sector, comprising of 81% of the market revenue in 2018. The second largest sector is OLED TVs which are 16% of the total market by revenue in 2018. Despite being 16% of the revenue, OLED TVs are 40% of the market by area of display. Therein is the challenge for larger area displays - cellphones have smaller displays and can command premium margins, but larger devices (including tablets) typically have lower price points and lower margins but need larger, more expensive screens (albeit with lower resolution). The third largest OLED application is wearables, which is 2% of the total OLED display market value and 0.4% by area in 2018. The thinness, flexibility and appearance of the display are desirable versus LCDs.

Historic data for 2017 is provided as a reference in addition to forecasts to 2029. Data includes OLED displays split by application and area (disguised sample shown below) and value.

OLED Technologies Appraised - Processes, Unmet Needs, Roadmaps

In separate chapters, the report assesses each of the main layers of OLED displays including substrates, thin film transistors (TFTs), materials, barrier layers, transparent conductive film and manufacturing processes.

Options for each are assessed and compared, identifying which are being used by which application. Key players and their progress are identified.

The technology assessment also includes matching the technology against the market need. For example, the impact of the Rec.2020 digital standard for next generation ultra HD displays, to the roadmap from glass based displays to foldable displays, to the progress with printed displays and how the materials and manufacturing processes used are changing to enable that.

Latest Activities of OLED Companies

The latest activities of OLED companies are covered, including their state-of-the-art capability, technology and, where applicable, OLED manufacturing capacity. OLED panel makers/display providers covered include:

· Samsung

· LG Display

· AUO, Sony

· JOLED

· BOE

· CSOT

· EverDisplay (EDO)

· Tianma

· Visionox

· Skyworth

Quantum Dot Displays

In assessing the display industry, OLED Display Forecasts and Technologies 2019-2029: The Global Rise of Flexible and Foldable Displays also covers the advancement of Quantum Dot Displays in different guises of

· Edge Optic

· Film Type

· Color Filter

· On Chip

· Emissive

Each of these options is assessed with the outlook for versus OLED displays for different market types. Ten-year forecasts are ultimate provided showing the share of the market of these different technology types.

Other Flexible Displays & Lighting

The report also assesses other flexible display and lighting types, including for each the players, technologies, commercial success and applications. Technologies covered include

· Electrophoretic displays

· Flexible LCD displays

· Electrowetting displays

· AC electroluminescent displays

· Thermochromic displays

· Electrochromic displays

· OLED lighting

· Flexible LED lighting

Complete assessment of current and emerging flexible display technologies and markets

IDTechEx has been tracking the display industry since 2001. This report gives a detailed, impartial and realistic appraisal of the markets and technologies, leveraging the full expertise of IDTechEx analysts and the direct interviews with companies in the value chain. Key features of this report include:

· Detailed 10-year forecasts by market segment, by value and display area

· Detailed 10-year forecasts by display type (AMOLED rigid glass, AMOLED flexible / rigid plastic, AMOLED flexible / foldable, PMOLED, segmented, and microdisplays)

· 2017-2018 OLED data

· 10 year forecast of Quantum Dot Displays by type

· The current status on printed OLED displays

· Technologies and players in the OLED value chain (substrate, backplane, transparent conductor, barrier film)

· Company profiles based on direct interviews

· Quantum Dot Displays

· Electrophoretic displays

· Other flexible displays

· OLED lighting and flexible LED lighting

For more information on this report and other IDTechEx research, contact research@IDTechEx.com or visit www.IDTechEx.com/displays.

IDTechEx guides your strategic business decisions through its Research, Consultancy Events services, helping you profit from emerging technologies. Find out more at www.IDTechEx.com.

Table of Contents for OLED Display Forecasts and Technologies 2019-2029: The Global Rise of Flexible and Foldable Displays

1. EXECUTIVE SUMMARY

1.1. Drivers for Display Innovation: OLED Displays

1.2. Evolution of the OLED industry

1.3. Investments in OLED Displays

1.4. Global OLED Production Capacity

1.5. Drivers for Display Innovation: QDOT, MicroLED, E-Paper and Beyond

1.6. OLED Display Market 2017-2018 by Value and SQ Meters

1.7. OLED Display Forecasts 2019-2029 by Value

1.8. OLED Display Forecasts 2019-2029 by Area (Sq Meters)

1.9. OLED Display Forecasts 2019-2029 Area (sqm) by Form Factor (Rigid versus Flexible)

1.10. OLED Display Forecasts 2019-2029, Panel Numbers by Form Factor (Rigid versus Flexible)

1.11. OLED Displays for Cellphones 2019-2029, by number of units, form factor and value

1.12. When will foldable displays take off?

1.13. Flexible OLEDs: First Foldable Display Comes to Market

1.14. OLED Displays for Tablets and Computers 2019-2029, by number of units, form factor and value

1.15. OLED Displays for TV 2019-2029, by number of units, form factor and value

1.16. OLED Displays for TV: Outlook

1.17. OLED Displays for Automotive 2019-2029, by number of units, form factor and value

1.18. OLED Displays for Wearables 2019-2029, by number of units, form factor and value

1.19. OLED Displays for Industrial and Professional Equipment 2019-2029, by number of units, form factor and value

1.20. OLED Displays for Microdisplays 2019-2029, by number of units, form factor and value

1.21. OLED Displays for Other Applications 2019-2029, by number of units, form factor and value

1.22. Ten-year forecast for different QD solutions in displays in area by M sqm (film, color filter, on chip, edge optic, emissive QLED, etc.)

2. OLED TECHNOLOGIES

2.1. Drivers for OLED displays

2.2. OLED vs. LCD

2.3. OLED operating mechanism

2.4. OLED Display Sizes

2.5. OLED versus LCD: Colors

2.6. Why choose OLED over LCD?

2.7. OLED power consumption can be lower than LCD

2.8. Evolution of the OLED industry

2.9. Evolution of Form Factors of Displays for Cellphones and Tablets

2.10. Detailed history of OLED display

2.11. Market is still currently dominated by mobile phones

2.12. More than 1 billion mobile AMOLED displays shipped by Samsung by 2016

2.13. Smartphones: AMOLED gaining market shares

2.14. OLED Tablets are getting bigger and more affordable

2.15. Product trends: Bigger, better, faster

2.16. Large Area OLEDs: "White OLED" approach for TVs

2.17. The White OLED approach

2.18. LG supplies OLED panels to TV manufacturers

2.19. Competition in the TV market

2.20. The challenge of Rec 2020

2.21. New standard for Ultra HD

2.22. QLED: the next generation of OLED?

2.23. Main advantages over OLED

2.24. Samsung: quantum dots and the OLED dilemma

2.25. Quantum Dot OLED Hybrid Displays: Progress from Samsung

3. FLEXIBLE, FOLDABLE AND PLASTIC OLED DISPLAYS

3.1. Roadmap towards flexible AMOLED displays and flexible electronics devices

3.2. First step towards flexible: OLED on plastic substrate

3.3. The rise of plastic and flexible AMOLED

3.4. Case study: the Apple Watch

3.5. Case study: Motorola shatterproof screen

3.6. Key components needed for flexible AMOLED displays

3.7. From rigid OLED, to flexible and foldable OLED

3.8. Two different methods to manufacture on plastic

3.9. Choice of flexible substrates

3.10. Rayitek: rising challenger to Kolon on c-PI substrates?

3.11. Three TFT technologies for flexible displays

3.12. TFT technologies for flexible displays

3.13. Metal Oxide production process

3.14. IGZO enables large sized OLED TVs

3.15. Challenges with Organic TFTs

3.16. Apple LTPO Backplane: Power Saving By Combining LTPS and IGZO

4. OLED MATERIAL STACK

4.1. How do OLEDs work?

4.2. RGB vs White OLED

4.3. Fluorescence OLED materials (FL)

4.4. Phosphorescent OLED (PhOLED)

4.5. Evolution of materials in RGB OLED

4.6. Evolution of materials in WOLED

4.7. OLED Materials: Supplier Landscape and Market Shares

4.8. TADF: next class of materials?

4.9. TADF: Latest results

4.10. Hybrid TADF + Fluorescence OLED

4.11. General material comparison

4.12. How are the materials deposited today?

4.13. FMM limits scale, material utilization and PPI

4.14. OLED photolithography: the need?

4.15. The High PPI need for OLED displays

4.16. Photolithography polymer OLED

4.17. High PPI with photolith on small molecular OLEDs

5. PRINTING OLED DISPLAYS

5.1. The industry has not given up on printing yet

5.2. Inkjet printing can potentially lower production costs

5.3. Inkjet printing OLED displays

5.4. Inkjet printing: is it worth it?

5.5. R G B inkjet printing in displays

5.6. Printed OLED Displays: Kay Players

5.7. Printed OLED TVs

5.8. Inkjet Printing for OLEDs

5.9. Inkjet printed AMOLED finally commercial?

5.10. JOLED Printed OLED Strategy

5.11. Solution processed performance level (green)

5.12. Solution processed performance level (red)

5.13. Solution processed performance level (blue)

5.14. Performance of solution process vs VTE: lifetime

5.15. UDC: Organic vapour jet printing

5.16. Organic Vapor Jet Deposition (OVJD)

5.17. Performance of OVJD

5.18. Fraunhofer IAP'S ESJET printing

5.19. Sumitomo Chemical and CDT

5.20. Quantum Dot OLED Hybrid Displays: Progress from Samsung

5.21. Printing the TFT backplane

5.22. Printed OLED Displays (RGB light emitters predominately made by printing), Value, $ Millions

6. BARRIER FILMS AND THIN FILM ENCAPSULATION

6.1. Thin film encapsulation

6.2. Why do we need barriers for OLEDs?

6.3. Summary of barrier needs for OLEDs

6.4. Plastic substrates fall short of requirements

6.5. Challenges with flexible barrier materials

6.6. General approaches towards high performance encapsulation

6.7. Encapsulation

6.8. The basis of the multi-layer approach

6.9. Status of R2R barrier films in performance, web width and readiness/scale

6.10. From glass to multi-layer films to multi-layer inline thin film encapsulation

6.11. TFE is the technology of choice now for plastic and flexible OLED displays

6.12. Trends in in-line TFE: reducing thickness by cutting the number of layers in the barrier stack

6.13. Trends in TFE: Past, present and future of deposition methods

6.14. Inkjet deposition of organic coating

6.15. How inkjet printing has enabled thin film encapsulation

6.16. Inkjet printing organic layer in thin film encapsulation

6.17. Atomic layer deposition for encapsulation technology: will it give rise to single layer barrier films?

6.18. Ultra flexible thin glass

6.19. Flexible glass: an assessment

6.20. Duskan: organic layer for TFEs

6.21. Multi layer barrier for bottom barrier layer in flexible/rollable displays

7. TRANSPARENT CONDUCTIVE FILMS (TCFS)

7.1. Different Transparent Conductive Films (TCFs)

7.2. ITO film shortcomings: flexibility

7.3. ITO film shortcomings: limited sheet conductivity over large areas

7.4. Silver nanowire transparent conductive films: principles

7.5. Silver nanowire TCFs

7.6. Silver nanowire transparent conductive films: flexibility

7.7. Silver nanowire transparent conductive films: target markets

7.8. Silver nanowire TCF: haze trade-off

7.9. Metal mesh transparent conductive films: operating principles

7.10. Metal mesh: etching

7.11. Metal mesh: Ag halide patterning

7.12. Metal mesh: hybrid

7.13. Metal mesh: improvement in gravure offset printing?

7.14. PEDOT:PSS is now on a par with ITO-on-PET

7.15. Carbon nanotube transparent conductive films: performance

7.16. Carbon nanotube transparent conductive films: performance of commercial films on the market

7.17. Graphene performance as TCF

7.18. Transparent Conductive Film (TCF) Benchmarking

7.19. All ITO alternatives are mechanically flexible

7.20. Major trends: the threat of alternatives and price wars

7.21. Major trends: is there a winning alternative or a one-size-fits all solution?

8. FLEXIBLE TOUCH SENSORS FOR FLEXIBLE DISPLAYS

8.1. Major trends: transition from add-on to embedded

8.2. Major trends: the rise of flexible OLED displays

8.3. Major trends: transition from add-on to embedded

8.4. Major trends: the rise of flexible OLED displays

9. OTHER OLED DISPLAY CAPABILITIES

9.1. Under/in- display fingerprint sensors require OLED panel

9.2. Latest feature: flat panel speaker

9.3. Samsung's display integrated sound receiver

10. FLEXIBLE OLED DISPLAYS: COMPANY ACTIVITY

10.1. Global OLED Production Lines

10.2. Samsung Display (SDC)

10.3. Samsung demonstrates rollable and stretchable display

10.4. Samsung

10.5. Quantum Dot OLED Hybrid Displays: Progress from Samsung

10.6. LG Display (LGD)

10.7. LG Display

10.8. LG Display: Large area, transparent and flexible OLED display

10.9. BOE

10.10. BOE: Flexible OLED displays

10.11. BOE: flexible and printed OLED displays

10.12. Ink-jet printed display from BOE

10.13. Tinama's flexible OLED display technology

10.14. Tianma

10.15. Visionox: ultra flexible OLED displays

10.16. Visionox: flexible OLED displays

10.17. JOLED's flexible OLED display technology

10.18. JDI

10.19. AUO

10.20. Changhong

10.21. Skyworth

10.22. Royole

10.23. Denso

10.24. Duskan: leading HTL supplier in OLED display industry

11. OLED DISPLAYS: MARKET SEGMENTATION AND FORECASTS

11.1. OLED Display Market 2017-2018 by Value and SQ Meters

11.2. OLED Display Forecasts 2019-2029 by Value

11.3. OLED Display Forecasts 2019-2029 by Area (Sq Meters)

11.4. OLED Display Forecasts 2019-2029 Area (sqm) by Form Factor (Rigid versus Flexible)

11.5. OLED Display Forecasts 2019-2029, Panel Numbers by Form Factor (Rigid versus Flexible)

11.6. OLED Displays for Tablets and Computers 2019-2029, by number of units, form factor and value

11.7. OLED Displays for TV 2019-2029, by number of units, form factor and value

11.8. OLED Displays for Tablets and Computers 2019-2029, by number of units, form factor and value

11.9. OLED Displays for TV: Outlook

11.10. OLED Displays for TV

11.11. OLED Displays for Automotive 2019-2029, by number of units, form factor and value

11.12. Automotive

11.13. OLED Displays for Wearables 2019-2029, by number of units, form factor and value

11.14. OLED Displays for Industrial and Professional Equipment 2019-2029, by number of units, form factor and value

11.15. OLED Displays for Microdisplays 2019-2029, by number of units, form factor and value

11.16. OLED Displays for Other Applications 2019-2029, by number of units, form factor and value

12. QUANTUM DOT DISPLAYS

12.1. What are quantum dots?

12.2. Quantum dots: key characteristics

12.3. Color standards for Displays

12.4. How LED backlights reduced color performance

12.5. 100% sRGB can be achieved without QD

12.6. The challenge of Rec 2020

12.7. Displays: benchmarking various integration methods

12.8. Edge optic integration: a technology going obsolete?

12.9. Film type integration: growing commercial success but for how long?

12.10. Colour filter type: approaching commercial readiness?

12.11. On chip integration: improving stability

12.12. Emissive type: how far off from commercial readiness?

12.13. Key materials: Cd based QDs. Why?

12.14. Key issue with Cd based QDs?

12.15. Cd free QDs: Narrowing the performance gap

12.16. Snapshot of readiness level of various QD applications

12.17. Printing in Quantum Dot OLED Hybrid Displays

12.18. Ten-year forecast of change in QD technology mix in display sector (%)

12.19. Flexible Quantum Dot Displays

13. FLEXIBLE ELECTROPHORETIC (E-PAPER) DISPLAYS

13.1. Electrophoretic and other bi-stable displays

13.2. Electrophoretic e-readers decline - what's next?

13.3. The Holy Grail: Color E-paper Displays

13.4. New color display from E Ink without filters

13.5. Signage

13.6. E-ink Holdings

13.7. Clearink

13.8. The early years of flexible E-ink displays

13.9. Flexible EPD suppliers in 2018

13.10. Flexterra

14. FLEXIBLE LCD DISPLAYS

14.1. Flexible LCDs

14.2. Organic LCD (FlexEnable)

14.3. JDI

14.4. Flexible LCDs: Conclusions

15. OTHER FLEXIBLE DISPLAYS

15.1. Electrowetting displays

15.2. Electrowetting displays: Liquavista

15.3. Electrowetting displays: Etulipa

15.4. Electrochromic displays

15.5. Ynvisible Electrochromic Displays

15.6. AC Electroluminescent displays

15.7. EL technology

15.8. AC Electroluminescent (EL) Displays

15.9. Thermochromic Displays

16. FLEXIBLE LIGHTING: LED AND OLED

16.1. Value proposition of OLED vs LED lighting

16.2. OLED lighting: solid-state, efficient, cold, surface emission, flexible......?

16.3. OLED Lighting Status

16.4. Cost challenge set by the incumbent (inorganic LED)

16.5. Comparing OLED and LED lighting

16.6. OLED Lighting is more challenging than OLED displays in terms of lifetime and light intensity requirements

16.7. OLED lighting - cost projection

16.8. Market announcements

16.9. Technology progress

16.10. OLED Lighting - market penetration

16.11. OLED lighting value chain

16.12. S2S Lines: OLEDWorks in Aachen (ex-Phillips line)

16.13. S2S lines: LG display: Gen-2 and Gen 5

16.14. R2R line: Konica Minolta

16.15. But why is it so difficult to reduce cost??

16.16. OLED market forecast

16.17. OLED lighting- will it eventually disrupt?

16.18. Printed LED lighting

16.19. Nth Degree - Printed LEDs

16.20. Glossary of Key Terms

Media Contact:

Charlotte Martin

Marketing & Research Co-ordinator

c.martin@IDTechEx.com

+44(0)1223 812300

Source: IDTechEx