Georgia Small Business Borrowing Stalls in October - PayNet

CHICAGO, December 18, 2017 (Newswire.com) - In October 2017, Georgia's small firms borrowed similarly to last month, data released by PayNet indicates. Of the 18 major industries, 10 rose and 8 declined in Georgia.

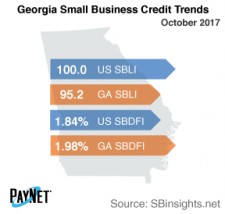

At 95.2, Georgia's PayNet Small Business Lending Index (SBLI) performed similarly to last month's state level, but was 4.8% lower than the national SBLI level of 100.0 this month. The index is basically unchanged from a year ago.

With minimal improvement in borrowing and relatively high defaults, small business financial health has fallen.

William Phelan, President

The three industries with the greatest improvement in lending activity over the past year in Georgia were Mining, Quarrying, and Oil and Gas Extraction (34.9%); Educational Services (25.8%); and Arts, Entertainment, and Recreation (25.1%). As well as having the greatest improvement this month, Mining, Quarrying, and Oil and Gas Extraction also recorded the highest lending activity (223.4) of all industries in Georgia.

After a comparable value to the previous month, Georgia's PayNet Small Business Default Index (SBDFI) of 1.98% was 14 basis points higher than the national SBDFI level of 1.84%. Year-over-year, the national SBDFI climbed 2 basis points, whereas Georgia's SBDFI dipped 18 basis points.

"With minimal improvement in borrowing and relatively high defaults, small business financial health has fallen," states the president of PayNet, William Phelan.

Source: PayNet