Five-Star Money Manager's Brazen Attempt to Change the Financial Services Industry

Grand Rapids, Michigan, June 29, 2017 (Newswire.com) - Five-Star Money Manager and Author of Asset Rotation, Matthew P. Erickson is standing up against the pillars of Wall Street, and fighting for the well-being of investors. After nearly one year of collaboration, Renaissance Capital Management, LLC’s Co-Founders, Matt Erickson and Robert Mitus, have launched a new division within their company, AlphaGeneration Subscription Services. For the first time, investors have the ability to access more than 25 of Erickson’s top investment strategies through a low-cost subscription membership to www.MyAlphaGeneration.com.

“Typically, Money Managers seek out sub-advisory opportunities managing money for other firm’s clients, or offer their strategies to the marketplace as a mutual fund. Both roads lead to higher fees ultimately borne by individual investors. We think there’s a better way,” Erickson explains.

"Typically, Money Managers seek out sub-advisory opportunities managing money for other firm's clients, or offer their strategies to the marketplace as a mutual fund. Both roads lead to higher fees ultimately borne by individual investors. We think there's a better way."

Matthew P. Erickson, Co-Founder, CEO & Chief Investment Officer

According to Ben Johnson of Morningstar, “Over the trailing three-year period ending April 30, U.S. domiciled actively managed mutual funds and exchange traded funds witnessed collective outflows of nearly $514 billion. Passively managed mutual funds and ETFs collected nearly $1.57 trillion in net new money during that same period.”

Erickson cites a number of reasons for this dramatic divergence, “Over the past three years, more active managers have underperformed their passive benchmarks than at any other point in history. At the same time advisors are faced with increased scrutiny to defend the use of more expensive products and strategies, as the newly adopted DOL Rule requires disclosure of all underlying investment fees. It’s only common sense that one would choose to lower costs to remain competitive, and the easiest way to do that is to use less expensive passive investments. We think this is a good thing, but in doing so, advisors run the risk of commoditizing themselves with regard to the investment solutions they provide, while further locking in net-of-fee underperformance. We believe the investment community is missing the bigger picture.”

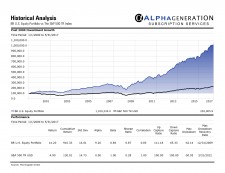

Erickson and Mitus contend that the real argument should not focus on whether investors stand the greatest chance of achieving success using either passive or active investments. Rather they believe superior top-line and risk-adjusted performance can be most consistently obtained through active management of passive investments. By adhering to historically justified rules-based disciplines, devoid of emotional bias, they’ve created strategies to fit all investor risk-profiles: from the ultra-aggressive to the most conservative, and even for those seeking increased tax efficiency. Strategy categories under AlphaGeneration include: Tactical Managed ETF Portfolios, Beta Rotation Strategies, Quantamental Stock Portfolios, as well as Low Volatility and Strategic Allocations.

“For far too long, investors have over-paid for underperformance. As a Money Manager, we’re in opposition to anything that unnecessarily lessens our performance, and ultimately reduces a client’s returns. Rather than follow a conventional path, adding layer upon layer of fees, we’re providing investors with a more cost effective, direct solution,” states Robert Mitus.

AlphaGeneration Members receive emailed trade alerts on all portfolios, detailed analytics to ensure they have the information necessary to make the right decisions, Fact Sheets and Historical Illustrations, and a Monthly Market Update so that they can remain up-to-date with current market conditions. All strategies are systematically traded on predetermined dates, with no more than one trade date per month. Subscription services are available on an advisory level for financial professionals, as well as for individual investors. For investors who do not wish to manage their own accounts, all strategies are also available through sub-advisory or direct investment relations with Renaissance Capital Management, LLC at www.rcmportfolios.com.

Media Contact:

Matthew P. Erickson

Phone: 888-308-3993, Ext. 3

Email: merickson@rcmportfolios.com

Source: Renaissance Capital Management, LLC