Credit Clock Reviews 2025: AI-Driven Toolkit for Credit Score Growth, Debt Relief, and Financial Resilience

Credit Clock Reviews 2025 outline a toolkit that supports credit score improvement, debt reduction strategies, and long‑term financial stability for consistent users.

HOUSTON, August 20, 2025 (Newswire.com) - The information below is provided for general informational purposes only and does not constitute financial or professional advice. Funding availability, terms, and approval times may vary by applicant and lender. Always confirm details directly with the official provider before applying for financing. If you apply through links in this article, the publisher may earn a commission at no additional cost to you.

Credit Clock Reviews 2025: AI-Driven Toolkit for Credit Score Growth, Debt Relief, and Financial Resilience

Visit the Official Credit Clock Website

TL;DR Summary

Credit Clock Reviews 2025 reveal a financial toolkit built to help individuals strengthen credit scores, reduce debt burdens, and establish long-term financial resilience. While results vary by user, many report steady improvements when using the platform consistently.

In This Article, You'll Discover:

How Credit Clock works and why it's trending in 2025

Real Credit Clock reviews and user experiences

Key benefits and potential drawbacks of the platform

How it compares against traditional credit repair and AI finance apps

Pricing details, hidden fees, and discount options

Who should and should not use Credit Clock

Introduction

Credit health is one of the most powerful forces in modern financial life. A strong credit score opens the door to mortgages, auto financing, and premium credit cards, while a weak score can block opportunities. In 2025, consumers are turning to smarter tools to take control of this crucial metric. Among these tools, Credit Clock is quickly becoming one of the most discussed solutions for those seeking to regain financial footing.

Unlike traditional credit repair services that operate behind closed doors, Credit Clock promotes a transparent, user-first approach. The platform combines AI-driven analytics, debt management tools, and actionable education to guide users toward measurable credit improvement. As a result, search interest in Credit Clock reviews has surged, with consumers eager to understand whether it delivers on its bold promises.

Part of the excitement stems from larger financial trends. With AI-enhanced financial protocols and resilience-focused credit strategies dominating fintech in 2025, users are searching for solutions that balance cutting-edge innovation with practical outcomes. Credit Clock is positioned at this crossroads, offering both advanced tools and everyday usability.

For those considering whether this system is worth it, you can see real user results of Credit Clock here before exploring the full review below.

What is Credit Clock?

Breaking Down the Concept

Credit Clock is a financial optimization system designed to help users strengthen credit scores, dispute inaccuracies, and manage debt in a structured way. Unlike agencies that charge large fees while keeping processes hidden, the platform empowers users with self-directed, step-by-step guidance backed by data.

It functions as both an educational resource and a results-driven companion. Users receive a clear roadmap that includes personalized milestones, tracking dashboards, and progress prompts to ensure they stay on course toward credit health improvement.

Why It's Trending in 2025

The year 2025 has seen explosive demand for credit resilience toolkits and AI-driven optimization stacks. With rising interest rates, stricter lending standards, and more consumers seeking refinancing, tools like Credit Clock are stepping in to fill the gap between generic financial apps and expensive credit repair firms.

By focusing exclusively on credit and debt management, Credit Clock offers depth where competitors offer only breadth. This laser focus has positioned it as a trending option in a rapidly evolving financial marketplace.

How Does Credit Clock Work?

Step-by-Step User Journey

Credit Clock starts with a comprehensive credit health snapshot, providing users with a detailed view of their score, account history, and financial obligations. From there, the platform generates a personalized action plan that includes steps like disputing inaccurate items, reducing utilization ratios, and creating optimized repayment schedules.

Each goal is broken down into manageable tasks, making it easier for users to maintain momentum. This approach ensures that even first-time users unfamiliar with financial terms can move confidently through the process without confusion.

Financial AI Integration

What sets Credit Clock apart is its AI-powered financial engine, which analyzes patterns in spending, repayment, and utilization to make tailored recommendations. Examples include sequencing debt repayments for maximum credit impact, flagging behaviors likely to lower scores, and suggesting opportunities to diversify credit profiles.

This transforms Credit Clock from a passive monitoring service into an active optimization toolkit, ensuring users can adapt quickly to the evolving financial landscape of 2025.

For a closer look at its data-driven system, you can explore the science behind Credit Clock here.

Credit Clock Reviews 2025 - Real User Insights

Positive Reviews

Users frequently highlight the platform's clear guidance, intuitive dashboard, and motivational tracking tools. Many report that Credit Clock's combination of education and automation allowed them to see steady improvements over a few months.

Key positives include:

Transparency: Each step is explained, avoiding hidden tactics or vague promises.

Control: Users retain ownership over their progress rather than outsourcing it.

Results: Several reviewers mention measurable score increases within three to six months, especially when following the platform's recommended repayment strategies.

For many, seeing progress visualized in the dashboard helps maintain discipline, creating an accountability cycle that reinforces commitment.

Negative Experiences

Not all reviews are glowing. Some users express frustration that results take time and effort, especially those expecting instant fixes. Others cite delays in customer support responses during peak demand.

Additional drawbacks include:

Learning Curve: While designed for accessibility, users still need to engage consistently.

Variable Outcomes: Results depend heavily on individual histories, debt levels, and follow-through.

Time Commitment: Those unwilling to regularly update and track progress may find the system less effective.

Overall, most Credit Clock reviews indicate strong potential for those who commit to the process, but less success for those looking for a shortcut.

Comparisons: Credit Clock vs. Alternatives

Traditional Credit Repair Services

Traditional credit repair companies often market themselves as a one-stop solution, but their approach is usually built around high service fees, ongoing subscriptions, and limited transparency. These firms typically handle disputes on behalf of clients but rarely educate them on maintaining long-term financial health. Users become dependent on external consultants, which can create ongoing costs without lasting independence.

Credit Clock takes a different approach. Instead of outsourcing, the platform hands the tools and knowledge directly to users, offering a structured system that is both cost-effective and empowering. By combining automation with guided education, it eliminates the mystery behind credit repair and allows individuals to actively shape their outcomes without being locked into high-fee contracts.

AI-Powered Finance Apps

Many popular finance apps use AI to track spending, manage budgets, and highlight savings opportunities. While helpful for overall financial planning, these apps often treat credit improvement as a secondary feature. Their focus tends to be broad, spreading across budgeting, investment, and bill reminders without providing depth in any single area.

Credit Clock, however, was designed with credit optimization as its core mission. Its AI system doesn't just suggest budgeting tips - it provides credit-specific insights, such as the most efficient order to repay debts, predictive alerts about behaviors that may hurt scores, and tailored strategies to build credit diversity.

For users deciding between a generic financial app and a dedicated credit toolkit, the distinction is clear: Credit Clock offers specialized precision, whereas most AI finance apps deliver general coverage. Those serious about credit health are more likely to benefit from the targeted design of Credit Clock.

For anyone comparing their options, you can visit the official Credit Clock website here to explore what sets it apart from both traditional repair firms and generic finance apps.

Key Benefits of Using Credit Clock

Credit Score Optimization

Credit Clock provides users with a personalized roadmap to credit score improvement, ensuring that each action step is designed for measurable impact. Instead of offering generic tips like "pay your bills on time," the system analyzes utilization ratios, repayment histories, and account structures to recommend targeted adjustments. This level of precision can mean the difference between a marginal bump in credit and a substantial score increase that unlocks new lending opportunities.

For individuals preparing for mortgages, auto loans, or refinancing in 2025, these optimizations can be critical. By focusing on high-impact areas first, Credit Clock maximizes the efficiency of every action taken.

Debt Management Tools

The platform also incorporates a debt reboot system that prioritizes repayment strategies based on their effect on both credit score and long-term savings. Instead of applying the same formula to every user, Credit Clock calculates the most advantageous repayment order by weighing balances, interest rates, and scoring implications.

This structured approach can save users hundreds or even thousands in interest while strengthening their credit profiles simultaneously. Unlike basic budgeting tools, Credit Clock addresses the direct relationship between debt repayment and score improvement, making it far more effective for users focused on credit growth.

Financial Resilience Strategies

Beyond short-term fixes, Credit Clock functions as a financial resilience toolkit. Users benefit from adaptive AI alerts that warn against score-threatening behaviors, progress tracking that visualizes milestones, and educational modules that reinforce long-term habits.

This proactive system ensures that users aren't just repairing credit temporarily - they're building durable strategies to withstand economic shifts, lender scrutiny, and future debt challenges.

For readers seeking structured support in these areas, you can learn more about Credit Clock benefits here and review how the toolkit compares to traditional services.

Potential Risks and Considerations

Who Should Avoid Credit Clock?

While Credit Clock is an effective platform for many, it isn't a universal fit. Users seeking instant results or quick-fix solutions may find the program frustrating. The system is designed for consistent, long-term engagement, not overnight miracles. Individuals unwilling to commit to steady follow-through are less likely to see meaningful improvements.

Those facing severe financial complications, such as active bankruptcies, ongoing lawsuits, or complex debt settlements, may also find that Credit Clock only partially addresses their needs. In such cases, the platform should be seen as a complementary tool, not a full replacement for professional legal or financial guidance.

Limitations of the Platform

Although Credit Clock is built to streamline credit improvement, outcomes depend heavily on user behavior. Missing action steps, failing to update accounts, or not adhering to recommendations can slow progress. Some users also report slower-than-expected improvements when their credit histories are already saturated or have deeply entrenched issues.

A few reviewers mention delays in customer support response during periods of high demand. While not widespread, these experiences underline the need for patience when seeking assistance.

Ultimately, Credit Clock is most effective for proactive individuals who are ready to engage actively in their financial recovery process. For those individuals, the platform can be a highly valuable tool.

If you'd like to evaluate whether the advantages outweigh these risks, you can visit the official Credit Clock website here and review the platform's full details.

Reddit-Style Search Questions

"Is Credit Clock Legit or a Scam?"

One of the most common search queries about Credit Clock on forums like Reddit is whether the platform is truly legitimate. Skepticism is natural in the financial services industry, especially given the history of overpriced and underdelivering credit repair firms. The overwhelming majority of user feedback, however, points to Credit Clock being a legitimate, results-driven toolkit.

Unlike scams that promise overnight score fixes, Credit Clock is upfront about its process: results require consistent engagement and adherence to structured steps. The transparency of its dashboard and educational resources reinforces its credibility compared to less forthcoming competitors.

"Does Credit Clock Really Fix Bad Credit Fast?"

Many potential users also search for reviews questioning whether the system delivers rapid results. The reality is that while some users report improvements within the first few months, Credit Clock is not a magic button. The speed of progress depends heavily on individual credit profiles, existing debt, and the effort invested in following the program.

For those seeking sustainable improvement rather than temporary patches, Credit Clock is positioned as a long-term optimization toolkit rather than a "fast-fix" service.

"Is Credit Clock Worth It in 2025?"

A final recurring question across community forums is whether Credit Clock is worth the investment compared to free tools and basic budgeting apps. For many users, the platform's specialized focus on credit health makes it far more effective than general-purpose financial apps.

The added value lies in its combination of AI-driven recommendations, targeted credit improvement workflows, and resilience-building strategies. For users who prioritize credit growth as a financial goal in 2025, many reviews suggest the platform justifies its cost.

If you're weighing whether to invest, you can see real user experiences of Credit Clock here to determine if the results align with your expectations.

Pricing, Packages, and Discounts

Latest Credit Clock Pricing 2025

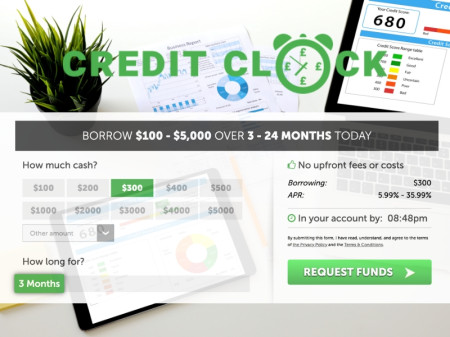

As of 2025, Credit Clock offers tiered access designed to accommodate different financial situations. The entry-level plan focuses on core credit tracking and action steps, while premium tiers provide access to advanced AI-driven recommendations, priority support, and in-depth financial resilience training.

This structure allows users to start at a lower cost and upgrade as their needs evolve. Compared to traditional credit repair agencies, which often charge hundreds of dollars per month, Credit Clock's pricing is generally more affordable while still offering robust functionality.

Hidden Fees to Watch Out For

One of the biggest concerns in financial services is the presence of hidden fees. Many credit repair companies lock clients into long-term contracts or upsell expensive "consulting" sessions. Credit Clock avoids this practice by making its pricing transparent and upfront, allowing users to know exactly what they are paying for.

However, users should note that results may sometimes require upgrades to higher-tier plans, especially for those with complex credit issues. While not deceptive, this can increase costs for individuals with more advanced needs.

Discounts and Special Offers

Credit Clock occasionally provides seasonal discounts and promotional offers, particularly during peak financial planning seasons such as tax season or year-end. These promotions can reduce the overall cost of entry and make the platform even more accessible. Because pricing can fluctuate, prospective users should always check the official website for the latest deals.

For the most current rates and offers, you can visit the official Credit Clock website here and confirm today's pricing before enrolling.

Who Should Use Credit Clock?

Best Fit Demographics

Credit Clock is best suited for individuals who are motivated to take an active role in managing their credit health. This includes:

Young professionals seeking to establish credit histories and improve access to loans

Families looking to refinance mortgages or secure lower-interest auto loans

Individuals recovering from financial setbacks who need a structured path to rebuild credit

Consumers interested in leveraging AI-enhanced financial protocols rather than relying on expensive credit repair agencies

For users in these groups, the platform's combination of automation, education, and accountability provides a strong foundation for long-term financial success.

Who It's Not Right For

On the other hand, Credit Clock may not be the right solution for everyone. Users who expect instant results without consistent effort may be frustrated by the step-by-step approach. Similarly, those with extremely complex financial cases - such as active bankruptcies or litigation - may require professional legal or credit repair services in addition to what Credit Clock provides.

The platform is also not designed for individuals unwilling to engage with financial education. While its interface is intuitive, true success comes from applying the knowledge provided, not simply monitoring numbers.

If you fall within the target group and want to see whether the system aligns with your goals, you can visit the official Credit Clock website here to explore the program in detail.

Final Verdict on Credit Clock Reviews 2025

Editor's Assessment

After reviewing Credit Clock's features, user feedback, and industry positioning, it's clear that the platform offers a valuable middle ground between costly credit repair firms and generic finance apps. Its structured workflows, AI-powered recommendations, and focus on credit-specific outcomes make it stand out in a crowded financial technology landscape.

The strongest appeal lies in its transparency and control. Users are empowered with knowledge and tools to actively improve their financial health instead of passively relying on consultants. For those willing to commit to steady action, Credit Clock provides a clear pathway to measurable results.

Should You Try Credit Clock?

Whether Credit Clock is the right choice comes down to individual expectations. If you're looking for a sustainable way to optimize your credit score, manage debt more effectively, and build financial resilience, the platform is worth serious consideration. On the other hand, if you expect quick fixes without consistent effort, you may find the process slower than anticipated.

Overall, Credit Clock is best suited for proactive individuals who value both cutting-edge financial technology and self-directed empowerment. It's not a miracle cure, but for those who follow its structured system, it can deliver meaningful and lasting improvements.

To make an informed decision, you can see real user results of Credit Clock here and determine if its approach aligns with your personal financial goals.

Final Thoughts: Is Credit Clock Right For You?

Credit Clock represents a shift in how individuals approach credit repair and debt management in 2025. By combining AI-driven personalization, transparent workflows, and a focus on long-term resilience, it offers far more than a quick fix. For motivated users, it delivers a reliable roadmap to higher credit scores and better financial opportunities.

Those who expect results without effort, however, may find it less rewarding. Success with Credit Clock depends on consistent engagement and willingness to follow through on the program's recommendations. For individuals prepared to commit, the payoff can be significant - both in financial freedom and peace of mind.

If you're ready to explore the program in more detail, you can visit the official Credit Clock website here and review current offers, features, and success stories.

Contact: business@paydayventures.com

Affiliate & Legal Disclaimers

This article contains affiliate links. If you purchase through these links, we may earn a small commission at no extra cost to you.

Results may vary. Testimonials are based on individual experiences and are not guaranteed.

Pricing and discounts may change. Please refer to the official website for the most current offers.

This article is for informational purposes only and does not constitute financial or legal advice. Always consult a qualified advisor before making financial decisions.

Not intended as a substitute for professional credit repair or legal representation.

Source: Credit Clock