Colorado Small Business Defaults Fall in September

Chicago, IL, November 21, 2017 (Newswire.com) - In September 2017, fewer small businesses defaulted on loans in Colorado, according to data released by PayNet. Of the 18 major industries, 12 improved and 6 worsened in the state.

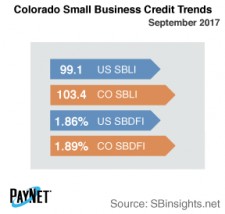

PayNet’s Small Business Default Index (SBDFI) for Colorado registered at 1.89% following a 6 basis point improvement from August. Compared to the national SBDFI level of 1.86%, Colorado's SBDFI was 3 basis points higher. The decline in defaults over the past two months may signal better business conditions in the state. The national SBDFI rose 7 basis points year-over-year, whereas Colorado's SBDFI dipped 6 basis points.

The industries with the highest default rates in Colorado were Mining, Quarrying, and Oil and Gas Extraction (4.58%); Transportation and Warehousing (3.45%); and Information (2.91%). Nationally, Mining, Quarrying, and Oil and Gas Extraction had a default rate of 3.05%, with a difference of --1.37% compared to the prior year, while Colorado had a variance of -1.32%.

The PayNet Small Business Lending Index (SBLI) for Colorado came in at 103.4, exceeding the national SBLI level (99.1) despite falling by 0.3% from last month's state level. The Index is basically unchanged from a year ago.

"With moderate investment and relatively low defaults, small business financial health remains above average," explains the president of PayNet, William Phelan.

Source: www.paynet.com