Colorado Small Business Defaults Down in October, Borrowing Up

CHICAGO, December 18, 2017 (Newswire.com) - Data published by PayNet show that fewer Colorado small businesses defaulted on loans and the level of borrowing activity rose in October 2017. The data suggest that financial conditions in the state may improve.

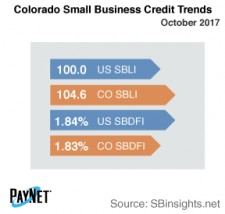

The PayNet Small Business Default Index (SBDFI) for Colorado registered at 1.83% following a 7 basis point reduction from September. Colorado's SBDFI was 1 basis points under the national SBDFI level of 1.84%. The decrease in defaults over the past three months may signal improving financial health in the state. The national SBDFI increased 2 basis points year-over-year, whereas Colorado's SBDFI fell 11 basis points.

It appears the economy is improving and will soon be able to resume expansion.

William Phelan, President

Mining, Quarrying, and Oil and Gas Extraction (4.09%); Transportation and Warehousing (3.60%); and Information (3.07%) displayed the worst default rates of all industries in Colorado. Nationally, Mining, Quarrying, and Oil and Gas Extraction had a default rate of 3.09%, with a difference of -1.43% compared to the prior year, while Colorado had a variance of -2.17%.

Registering at 104.6, the PayNet Small Business Lending Index (SBLI) for Colorado improved 1.0% from last month's state level and was 4.6% greater than this month's national SBLI level (100.0). The Index is basically unchanged from a year ago.

"It appears the economy is improving and will soon be able to resume expansion," states William Phelan, president of PayNet.

Source: PayNet