CashUSA Personal Loans Review 2025: Request Up to $10,000 Online Fast & Secure

CashUSA Personal Loans 2025 Review: Best Online Loan Connection Service to Request Up to $10,000

NEW YORK, September 19, 2025 (Newswire.com) - CashUSA.com is not a lender, broker, or creditor. All loan offers come from independent lenders or partners in the CashUSA network. Loan availability, terms, and APRs vary by state and lender. Always review the terms of any loan before accepting. Check the official website for the most current details as pricing and conditions may change at any time. This article contains affiliate links. If you purchase through these links, a commission may be earned at no additional cost to you.

Best Online Loan Connection Service to Request Up to $10,000 - Reviewing CashUSA Personal Loans

TL;DR Summary: CashUSA is a free online loan connection service that helps consumers request personal loans up to $10,000. It connects borrowers with lenders in minutes, providing a secure and simple path to review offers without obligation.

In This Article, You'll Discover:

Why personal loans through CashUSA matter in 2025 for debt consolidation, home projects, or emergencies.

What CashUSA is and how the service connects you with lenders nationwide.

The benefits of using a personal loan connection service compared to traditional bank loans.

How to use CashUSA in daily financial planning and manage repayment.

Expert and industry insights about personal loan usage and online loan matching.

Real customer experiences, testimonials, and success stories.

How CashUSA compares with other online loan request platforms.

Introduction: Why Personal Loans Matter in 2025

Personal loans continue to be one of the most flexible financial tools for U.S. consumers in 2025. Whether you are looking to consolidate debt, manage an unexpected expense, or cover the cost of a family trip, a personal loan can provide quick access to funds. Traditional bank loans often take weeks of paperwork and strict requirements, but online loan connection services like CashUSA streamline the process.

By filling out a short online form, borrowers may connect with lenders offering loan amounts up to $10,000. The goal is speed, security, and convenience. With CashUSA, you request a loan from the comfort of your home and may receive funds in your checking account as soon as the next business day if approved.

Visit the Official CashUSA Website

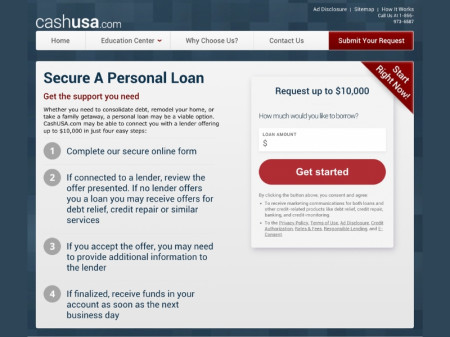

What Is CashUSA and How Does It Work?

CashUSA is an online loan connection service that helps consumers request personal loans ranging from $500 to $10,000. Unlike a direct lender, CashUSA does not issue loans itself. Instead, the platform uses a secure network of lenders and lending partners who review your information and may provide loan offers tailored to your profile.

The process is straightforward and designed for speed:

Complete the secure online loan request form in minutes.

If a lender reviews your request, you can see the offer presented.

Review the terms carefully, including the APR, repayment schedule, and fees.

If you accept the offer, funds may be deposited into your bank account as soon as the next business day.

CashUSA simplifies the loan request process by acting as the middle point between borrowers and lenders. If no lender extends a loan offer, you may receive marketing offers for related services such as debt relief, credit repair, or credit monitoring.

This model allows consumers to explore multiple options quickly without the stress of going from bank to bank. The convenience factor is one of the strongest reasons borrowers turn to CashUSA in 2025.

Best Personal Loan Options and Benefits in 2025

Personal loans remain one of the most versatile forms of financing in 2025. With CashUSA, you gain access to a wide network of lenders offering different loan amounts, repayment terms, and rates depending on your profile.

While terms vary by state and lender, borrowers often turn to CashUSA for several key benefits:

Fast approvals. Many loan requests are reviewed within minutes.

Quick funding. Approved borrowers may receive money in their account as soon as the next business day.

Convenience. Everything happens online with no need to visit a branch or complete heavy paperwork.

Flexibility. Loan amounts can range from $500 to $10,000, covering a variety of personal needs.

Privacy and security. All requests are handled through encrypted systems to protect your personal information.

No upfront cost. Submitting a request on CashUSA is free, with no obligation to accept any offer.

Additional resources. If a loan offer is not available, you may receive alternative options like debt relief or credit repair services.

For borrowers seeking a streamlined way to compare offers without pressure, CashUSA stands out as one of the most accessible personal loan request platforms available today.

Read More: Best No Credit Check Lending Option for Personal Loans in 2025

How to Use CashUSA in Daily Life or Business Operations

CashUSA is designed to be simple enough for everyday consumers yet versatile enough to support broader financial goals. Whether you need quick relief or structured financing, the platform offers options that can fit multiple situations.

Here are common ways borrowers use CashUSA:

Debt consolidation. Combine multiple high-interest debts into a single payment, potentially reducing financial stress.

Home improvement. Fund remodeling projects, appliance upgrades, or emergency repairs without tapping into savings.

Emergency expenses. Cover medical bills, car repairs, or other unexpected costs that demand immediate attention.

Travel or family needs. Use loan funds for vacations, weddings, or major family events without draining credit cards.

Small business expenses. Some borrowers apply personal loan funds toward operational needs, equipment, or short-term cash flow support.

The process works seamlessly with your daily routine. Once approved, funds are electronically deposited into your checking account, and repayment is handled automatically through scheduled withdrawals. This automation reduces missed payments and makes budgeting easier.

CashUSA positions itself as more than a loan request form - it acts as a financial bridge between immediate needs and longer-term planning.

Expert Insights and Industry Research on Personal Loans

Financial experts often highlight personal loans as one of the most adaptable lending tools in the U.S. market. Industry research in 2025 shows steady consumer demand for online loan platforms as borrowers seek faster approval times, less paperwork, and greater flexibility compared to traditional banks.

Reports from lending associations point out several trends shaping the personal loan space:

Digital-first borrowing. More than half of U.S. personal loans are now requested online rather than through in-person applications.

Loan accessibility. Many consumers with fair or average credit turn to connection services like CashUSA because they simplify the lender search.

Debt management. Personal loans are increasingly used to consolidate credit card balances, providing structured repayment with fixed terms.

Transparency demands. Consumers expect clear disclosures about APRs, repayment schedules, and fees before committing.

Experts also caution borrowers to approach loan offers responsibly. While the convenience of online connections is undeniable, each loan comes with its own interest rates, repayment terms, and potential impact on credit. Reviewing the terms in detail before accepting is critical.

For borrowers who want a balance between speed and responsible borrowing, CashUSA reflects the direction the lending industry is moving: secure, online, and borrower-friendly.

Success Stories, Testimonials, and User Experiences with CashUSA

Thousands of borrowers across the United States have used CashUSA to explore loan options when traditional routes felt limited. While results vary depending on individual credit history, income, and lender requirements, customer stories highlight the service's convenience and speed.

Common themes from user experiences include:

Quick relief. Many borrowers report receiving funds in their checking account as soon as the next business day after accepting a loan offer.

Debt payoff support. Users often describe using their loans to consolidate credit card balances into one predictable payment.

Transparent process. Customers appreciate being able to review loan terms before making any commitments.

No obligation. Several reviewers note peace of mind knowing they could decline offers without fees or penalties.

Alternative offers. Some individuals who did not qualify for a loan mention being connected with debt relief or credit repair services, giving them additional options to improve their financial situation.

Testimonials show that CashUSA appeals to those seeking a discreet, fast, and secure way to compare potential lenders. While not every borrower receives the exact loan they want, the service has helped many users navigate financial challenges more efficiently.

Learn How Others Use CashUSA Successfully

Comparing Personal Loans vs Alternatives in 2025

When evaluating financing options, borrowers often weigh the pros and cons of personal loans against alternatives like credit cards, payday loans, or home equity lines of credit.

Each option has different features that matter depending on your financial situation.

Personal loans. Provide fixed interest rates, predictable monthly payments, and repayment terms that can span months or years. They are commonly used for debt consolidation, home improvements, and major expenses.

Credit cards. Offer convenience and rewards, but often carry higher variable interest rates. Minimum payments can stretch debt repayment for years if balances are not managed carefully.

Payday loans. Give very short-term access to cash, but often come with high fees and steep APRs that can trap borrowers in cycles of debt.

Home equity loans or lines of credit. Typically, they offer lower interest rates because they are secured by your property. They may not be accessible to renters or those unwilling to use their home as collateral.

Compared to these alternatives, personal loans through CashUSA provide a middle ground: fast online access, no collateral required, and a structured repayment plan. While loan terms vary by lender, the advantage lies in being able to review multiple offers without obligation before making a choice.

Safety, Risks, and Responsible Use of Personal Loans

Personal loans are powerful financial tools, but they must be used responsibly. CashUSA emphasizes consumer protection by working only with lenders required to follow federal and state laws. Borrowers should still understand both the safety measures and potential risks.

Safety measures with CashUSA include:

Encrypted online forms that protect your personal information.

Secure lender connections within a regulated network.

Clear disclosures provided by lenders before you accept any loan.

Risks and considerations include:

Interest and finance charges. APRs vary by lender and can be higher for borrowers with poor credit.

Non-payment consequences. Missed payments may result in late fees, collection activity, and negative impacts on your credit score.

Loan renewals. Some lenders may offer extensions, but this can increase the overall cost of borrowing.

Credit checks. Lenders may perform a credit check as part of the approval process, which can affect your credit profile.

Responsible borrowing starts with reviewing all loan terms, understanding repayment schedules, and ensuring the monthly payment fits into your budget. Personal loans should not be used as a long-term solution for ongoing financial hardship but rather as a temporary tool to meet specific needs.

CashUSA advises consumers to explore all available options and seek professional financial advice if they face serious difficulties.

Pricing, Packages, and Official Website for CashUSA

Submitting a loan request through CashUSA is completely free. The service does not charge borrowers any fees to connect with lenders or lending partners. Instead, CashUSA earns revenue from lenders and advertiser partners when a loan offer is presented.

While the platform is free for consumers, the actual cost of a personal loan depends on the lender. Each lender in the CashUSA network sets its own interest rates, fees, and repayment terms based on factors such as your credit profile, income, loan amount, and state regulations.

Important details to remember:

Loan amounts typically range from $500 to $10,000.

APRs and repayment terms vary widely by lender.

If approved, your lender will present all costs, rates, and repayment schedules before you decide whether to accept.

There is no obligation to accept any offer.

Pricing Disclaimer: Always check the official CashUSA website for the most current loan terms, rates, and eligibility requirements, as these may change at any time and vary by lender.

Check Current Pricing for CashUSA

Frequently Asked Questions About Personal Loans

Is CashUSA a direct lender?

No. CashUSA is not a lender, broker, or creditor. It is a free online service that connects borrowers with lenders and lending partners in its network.

How much money can I request through CashUSA?

You may request between $500 and $10,000, depending on the lender's terms, your credit profile, and state regulations.

How fast can I receive funds?

If you accept a lender's offer, funds may be deposited into your checking account as soon as the next business day.

Do I have to accept a loan offer?

No. There is no obligation to accept any offer you receive. You are free to decline if the terms do not fit your needs.

Does CashUSA charge fees?

No. Submitting a loan request on CashUSA is free. The service is supported by advertisers and lenders, not by fees charged to consumers.

Will CashUSA affect my credit score?

CashUSA itself does not perform credit checks. Lenders in the network may perform a credit check as part of the approval process, which may impact your credit.

What if I do not qualify for a loan?

If no loan offers are available, you may receive alternative options such as debt relief, credit repair, or other financial services.

Final Verdict: Is CashUSA the Best Personal Loan Connection Service for You?

CashUSA has positioned itself as one of the most recognized loan connection services in 2025. It stands out because it is free to use, simple to navigate, and provides access to a wide network of lenders offering personal loans up to $10,000.

For borrowers who value speed, convenience, and security, CashUSA delivers a practical solution. The online form only takes minutes, and approved funds may arrive as soon as the next business day. There are no upfront fees, and you remain under no obligation to accept any loan terms presented.

The service is not without limitations. Since CashUSA is not a lender, it cannot guarantee specific interest rates, approval, or loan terms. Final loan costs depend entirely on the lender you connect with. Borrowers with stronger credit histories may receive better offers, while others may be directed to alternative financial services such as debt relief or credit repair.

Overall, if you are searching for a straightforward way to compare personal loan offers online, CashUSA provides a safe, fast, and reliable starting point.

Bonus Section: Strategic Ways to Maximize Personal Loans in 2025

A personal loan is more than quick access to funds. When used strategically, it can help strengthen your financial position in 2025.

Here are a few smart ways to maximize the benefits:

Target high-interest debt first. Use loan funds to consolidate credit card balances or payday loans, which often carry higher rates.

Create a repayment plan. Budget carefully so monthly payments fit within your income, reducing the risk of late fees or defaults.

Invest in lasting value. Direct loan funds toward home improvements, education, or business operations that may generate long-term returns.

Avoid unnecessary borrowing. Only request the amount you need to avoid larger repayments and interest charges.

Stay informed. Review loan disclosures carefully and compare multiple offers before deciding which is best for you.

Leverage credit building. Timely repayment of a personal loan can help improve your credit profile over time.

By following these strategies, borrowers can use CashUSA not just as a short-term financial fix but as a stepping stone toward healthier financial management.

Contact Information

Company: CashUSA

Email: support@cashusa.com

Phone (US): 1-866-973-6587

Address: 3315 E Russel Rd Ste A-4 Box #105, Las Vegas, NV 89120

Disclaimers

Publisher Responsibility Disclaimer: The publisher of this article has made every effort to ensure accuracy at the time of publication. We do not accept responsibility for errors, omissions, or outcomes resulting from the use of the information provided. Readers are encouraged to verify all details directly with the official source before making a purchase decision.

FTC Affiliate Disclosure: This article contains affiliate links. If you purchase through these links, a commission may be earned at no additional cost to you.

Not a Lender: CashUSA.com is not a lender, broker, or creditor. The site does not make loans, broker loans, or make credit decisions. Loan offers, terms, and approvals come directly from lenders or lending partners in the CashUSA network.

No Guarantee of Approval: Submitting a request does not guarantee that you will be connected with a lender or approved for a loan. Loan availability, amounts, APRs, and repayment terms vary based on state law, lender requirements, and individual borrower information.

Pricing Disclaimer: Always review all loan terms before accepting any offer. Check the official CashUSA website for the most up-to-date pricing, APR ranges, and eligibility requirements as these may change at any time.

Financial Responsibility: Loans carry risks. Failure to repay may result in fees, collection activity, and negative credit reporting. If you face serious financial difficulties, consider alternative options or seek professional financial advice.

Legal Notice: Use of CashUSA.com is subject to the site's Terms of Use, Privacy Policy, Rates & Fees, and Responsible Lending policies. By submitting a request, you consent to these terms.

Source: CashUSA