Arizona Small Business Defaults Down in March, as is Borrowing

Chicago, IL, May 10, 2017 (Newswire.com) - Data released by PayNet show that the percentage of small businesses defaulting on existing loans has fallen in Arizona and the level of borrowing activity fell in March 2017. The data suggest that financial conditions in the state may begin to improve.

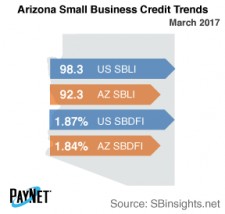

After a 3 basis point dip from February, Arizona's PayNet Small Business Default Index (SBDFI) of 1.84% was 3 basis points below the national SBDFI level of 1.87%. The decline in defaults over the past two months may signal improving financial health in the state. Year-over-year, both the Arizona and national SBDFI rose 25 basis points.

The three industries with the highest default rate in Arizona were Transportation and Warehousing (4.58%); Mining, Quarrying, and Oil and Gas Extraction (4.14%); and Admin & Support and Waste Management & Remediation Services (3.08%). Nationally, Transportation and Warehousing had a default rate of 4.49%, with a difference of +1.24% compared to the prior year variance of +0.71% in Arizona.

Registering at 92.3, Arizona's PayNet Small Business Lending Index (SBLI) fell 1.3% from last month's state level and was 6.1% below the national SBLI level this month. The Index is basically unchanged from a year ago.

"With lackluster investment and relatively low defaults, small business financial health remains above average," explains William Phelan, president of PayNet.

Source: www.paynet.com