Arizona Small Business Borrowing Stalls in February

Chicago, IL, April 13, 2017 (Newswire.com) - In February 2017, borrowing remained stagnant in Arizona, data released by PayNet indicates. Of the 18 major industries, 9 rose and 9 declined in Arizona.

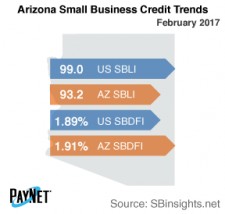

Coming in at 93.2, the PayNet Small Business Lending Index (SBLI) for Arizona performed comparably to the previous month's state level, but was 5.9% lower than the national SBLI level this month. The index is basically unchanged from a year ago.

Construction (32.9%); Manufacturing (20.5%); and Admin & Support and Waste Management & Remediation Services (19.6%) were the industries with the largest improvement in lending activity over the past year in Arizona. Nationally, Construction grew by 5.7% year over year.

PayNet’s Small Business Default Index (SBDFI) for Arizona stood at 1.91%. After a comparable performance to the previous month, Arizona's SBDFI was 2 basis points higher than the national SBDFI level of 1.89%. The national SBDFI rose 30 basis points compared to last year, while Arizona's SBDFI rose 28 basis points.

"Time will tell how these conditions will affect Arizona's economy going forward," asserts the president of PayNet, William Phelan.

Source: www.paynet.com