6 Steps to Choose the Right Payroll Software - Halfpricesoft.com Offers Small Businesses Quick Guide

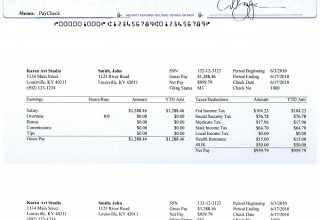

Houston, TX, December 9, 2014 (Newswire.com) - Payroll software can simplify small businesses payroll tasks. However buying the wrong payroll software can cost small businesses unnecessary time and money. In response to customers' requests, Halfpricesoft.com (http://halfpricesoft.tekplusllc.com), the developer of ezPaycheck payroll software, now offers a 6-step guide for small businesses.

"We have provided payroll tax solution to small businesses for over one decade. We believe small business owners should focus on growing business and not calculating payroll taxes. We hope our guide will help our customers to find the best payroll tax software solution." said Dr. Ge, President and Founder of halfpricesoft.com.

We believe small business owners should focus on growing business and not calculating payroll taxes

Dr Ge, President

Halfpricesoft.com always believes small business payroll software should be simple, flexible and affordable. Big, expensive and complex payroll suite may not be the right choice for new small employers. Many small business customers have limited budget. They should not be forced to pay some features that they will never need to use.

Customers can find this guide at http://www.halfpricesoft.com/articles/sb-payroll-software-how-to-choose.asp The six steps are:

Step 1: List the features a company need

First off, customers should list every feature and function that they need. Don't assume that they are included in all payroll software. Some are not.

Step 2: Separate must-have features from optional features and prioritize

Once customers have the list of features, identify which features they absolutely must have. Any product that doesn't have one of these features should not even be considered.

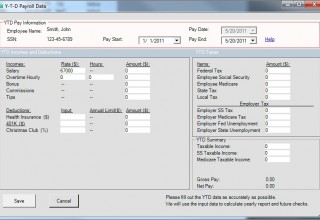

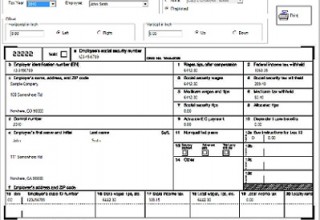

Step 3: Look for payroll software that can enter year-to-date payroll information

If they plan to change to a new payroll software in mid-year, make sure they purchase payroll software that lets them enter year-to-date payroll data for the employees.

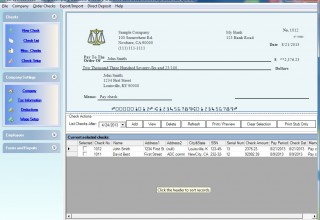

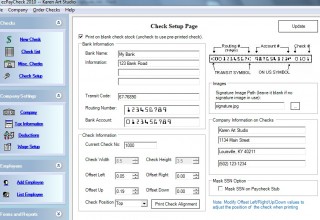

Step 4: Look for an easy-to-use interface

The key part here is the graphical interface - the window or screen that displays the options and accepts the data that you enter.

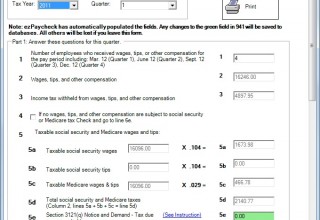

Step 5: Watch out for hidden fees for updating tax tables or use with multiple businesses

Tax rate tables change every year as tax laws change. Don't get stuck paying high fees to update the tax tables.

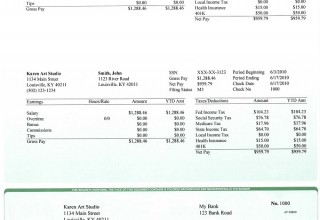

Step 6: Take potential software for a test drive

Many providers offer free trial version of payroll software that small business can download from their web site.

About Halfpricesoft.com

Founded in 2003, Halfpricesoft.com has established itself as a leader in meeting and exceeding the software requirements of small businesses around the world. Offering payroll software, employee attendance tracking software, check writing/printing software, W2 software, 1099 software and ezACH deposit software. It continues to grow in the philosophy that small business owners deserve affordable, user friendly, and totally risk-free software.

Customers seeking a way to simplify payroll processing with more accuracy can go online to http://halfpricesoft.tekplusllc.com/ezPaycheck.asp and download the payroll accounting software.