Liquidity VS. Solvency - Alexander Mirtchev Considers That Prioritizing Liquidity Over Solvency Will Determine Anti-Crisis Policies And Define The End-Game

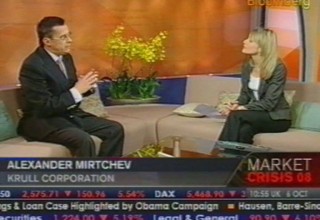

Online, May 5, 2011 (Newswire.com) - The effects of the global financial crisis continue to be felt throughout the global economy and have been exacerbated by the inability of governments to address the economic imbalances that were considered to be at the core of the crisis. According to Dr. Alexander Mirtchev, President of the Royal United Services Institute for Defence and Security Studies (RUSI) International, the varied responses to the current financial crisis undertaken by different governments over the last two and more years, have determined the shape of the recovery. As he previously discussed on Bloomberg Television, he considers the crisis to be more of a solvency and asset quality crisis rather than a liquidity crisis, and that government intervention in the markets by a number of countries ignores this issue at the peril of a number of unanticipated results in the ultimate end game post-crisis. In the developed countries' the "recovery strategy of choice" was focused on addressing the banking sector's liquidity problems rather than the more pertinent solvency problems faced by both the private and public sectors of those economies. On the other hand, continuing market reforms in some emerging markets could help alleviate the effect of the financial crisis and provide new leverage towards achieving global economic security equilibrium, as these markets are well positioned to effect remedies, if their leadership stays the course of economic reforms and modernization. Emerging markets have, in some cases, been bolder with plans to stabilize both the financial sector and to address systemic imbalances in their economies. However, Mirtchev warns that those economies that succumb to the pressure and try to transfer bad or "toxic" assets onto state balances face the potential of further debt constraints and the accompanying deterioration of financing terms for both the public and private sector. This, in turn, could impair their increasing global competitiveness and geopolitical influence.