State of Taxes in the Independent Economy 2022

We all know that “nothing is certain except death and taxes.” Yet not even the process of doing taxes is certain for everyone. In the case of independent workers, it’s radically different from those who are traditionally employed.

Today, more and more individuals are turning to the independent economy for their livelihood. They’re leaving traditional employment in 9-to-5 positions seeking out ways to make supplemental income, a new career path, a more flexible schedule, or better control over how they earn their income.

Whatever path they choose, the 68 million independent workers in the US today all face the same dilemma: Filing their taxes as 1099 workers, and no longer as W-2 workers. Unlike W-2 employees, independent workers don’t have the convenience of having taxes withheld automatically from their paycheck. Instead, they must calculate their owed federal, state, and even local income taxes and save enough every month to cover that obligation.

Last year, in our “State of Taxes in the Independent Economy 2021” report, we learned a lot about how independent workers navigate their tax filings, including if they’re withholding income for taxes, if they’re paying their quarterly estimated taxes, and if they find the process straightforward or confusing. In March 2022, we surveyed another round of independent workers to find out their experiences with filing their taxes, and to see where changes are being made and where there are still hurdles to jump.

The tax deadline is here. Are independent workers ready? Let’s find out.

Methodology

On March 14, 2022, we surveyed 1,003 Americans who earn the majority of their income as independent workers (receiving 1099s instead of W-2s) to find out more about their experiences with tracking their finances and paying their taxes.

Key Findings

Here are some of the insights we found about independent workers and how they approach their taxes:

47% aren’t setting aside income every month for their taxes. Because taxes are not withheld from their paychecks, independent workers must calculate the estimated tax owed on their income, and set aside a portion from each payout or paid invoice to pay that tax — but about half aren’t setting aside those funds.

49% say they don’t pay their quarterly estimated tax payments. To pay taxes that are owed and to avoid penalty, independent workers should pay estimated taxes quarterly (if expected taxes due will be $1000 or more). Half, however, are not doing so because they don’t know the process, or decide to wait and file yearly, incurring the penalty.

46% of independent workers worry they’ll be audited. Because the process of filing taxes is complex, time-consuming, and requires good record-keeping, independent workers fear getting audited for making a simple mistake.

18% haven’t started their 2021 tax filing — and don’t expect to have it done by the deadline. Even though tax time comes each April, 18% of our respondents don’t expect to meet the April 18 deadline (our survey was conducted one month before the deadline). That translates into nearly 12.5 million independent workers failing to file on time.

40% won’t be able to pay their taxes. Over one-third of respondents don’t believe they’ll be able to meet their tax obligations this year because of a lack of funds.

63% are concerned they’ll owe more than they thought. Their biggest concern is that because the process is confusing, they’ve made a mistake in their estimates, resulting in a higher tax bill than anticipated.

More independent workers are turning to professionals. Compared to last year, more independent workers are turning to online services like TurboTax or H&R Block or hiring professionals, and away from doing their taxes themselves, or having friends or family do it for them.

Table of Contents

Part 1 - Profile of Who We Surveyed

Part 2 - Experience Dealing With Taxes

Part 3 - Current Status of Tax Filings

Part 1: Profile of Who We Surveyed

For this report, we surveyed 1,003 individuals in the US who earn the majority of their income from independent work, whether that be through freelance work, gig work, on-call work, or anything else considered to be 1099 income.

Of those we surveyed, the largest age group represented (25.1%) fell between the ages of 35 and 44, with the next largest segment (24.6%) between the ages of 25 and 34. 16.8% were 24 or younger, 14.6% were between the ages of 45 and 54, and 18.5% were 54 or older. 52.4% identify as male, and 47.6% identify as female.

Most are gig workers and independent consultants / freelancers

Independent workers possess vastly different skills, work in different industries, can be as autonomous as they want, or can work whatever hours they want. The commonality is that they don’t work for W-2 wages from an employer. What types of independent workers participated in this survey? Most of our respondents (20.3%) are gig workers who work in the rideshare industry, make deliveries, or do other one-off work. The next largest group (18.7%) are independent consultants, professionals, or freelancers. 13.9% are on-call workers like substitute teachers and healthcare workers, and an additional 13.9% are content creators like podcasters, musicians, or streamers. 13.5% are merchants or sellers who either own a shop, sell online, or both. 19.7% replied “Other” — much higher than last year’s 11.2%, indicating increasing variety in the independent work options out there.

Some are new to independent work, but many have over five years of experience

There are those who have always structured their career around self-employed contract work, and there are those who have joined the independent economy just recently, either needing extra income during the pandemic or making the decision to follow their own path.

Neary a quarter of our respondents (24.3%) have been generating the majority of their income as an independent worker for over five years — an experienced group. 23.9% have been independent workers for one to three years, indicating that they started during the pandemic, perhaps as a way to gain lost income or as a career change.

Additionally, 17.5% have been independent workers for three to five years. 16.8% have been independent workers for less than 6 months, 17.6% have been independent workers for six to eleven months.

50% made over $50,000 from independent work in 2021

Since our respondents earn the majority of their income from 1099 work or other non-W-2 work (and note that any income $600 or more is reportable and taxable), we wanted to know what their income landscape was like in 2021.

The largest segment (27.7%) replied that they made under $24,999 from 1099 work in 2021. 22.5% made between $25,000 and $49,999, 18.4% made between $50,000 and $74,999, 15.3% made between $75,000 and $99,999, and 16.1% made over $100,000.

To simplify, 50.2% made $49,999 or less in 2021 and 49.8% made $50,000 or more. Compared to last year’s numbers, where 45.5% made $49,999 or less and 54.4% made $50,000 or more, independent workers are making slightly less in 2021 than they were in 2020.

Section Summary:

There is no one particular type of independent worker today. They can be freelance writers or Grubhub drivers. Some are on-call health care workers and some are substitute teachers. Many choose independent work to earn extra income on the side, or use it to build their career. They’re drawn to independent work for the more flexible hours and more autonomy, or simply for the better pay.

Despite the differences in independent workers, they all have one thing in common: They don’t have taxes taken out of their paychecks, and must bear the responsibility of calculating their own taxes, deductions, expenses, and more.

Part 2: Experience Dealing With Taxes

For those who are traditionally employed by an organization and who receive a W-2 each year, taxes are relatively straightforward: federal and state taxes (and Medicare and Social Security) are automatically withheld from each paycheck and summarized on a W-2.

Independent workers earning income outside a W-2, however, don’t have taxes automatically withheld and a summary sent to them for tax season. Instead, independent workers need to anticipate how much taxes they’ll have to pay, set aside a portion of their income for that payment, keep track of their deductions, pay into their estimated quarterly tax payments to both the IRS and their state, and more. Because there are more steps, more complexity, and more responsibility to get it right, we wanted to know about independent workers’ experiences with paying their taxes.

61% have filed as independent workers before, while 39% have not

Filing taxes as an independent worker is very different from W-2 tax filings, and includes more complexity, awareness, calculations, and budgetary planning. Have our respondents navigated filing taxes specifically for their 1099 income before this year?

60.8% had filed before, which is no surprise, considering that many of our respondents have been independent workers for a number of years. 39.2% have not yet filed taxes as an independent worker, so this year will be their first time doing so.

Last year’s numbers were nearly the same as this years, with 63.1% having previously filed, and 36.9% not having filed taxes as an independent worker.

For experienced independent workers, their biggest tax worry was the penalty for not paying estimated taxes correctly

For those who have filed taxes before as an independent worker, they cited a number of challenges they faced in the past, all with nearly equal weight. Their biggest challenges filing in the past were:

Worries about the penalty for not paying estimated taxes correctly (20%)

Not knowing what qualifies as a deduction (18.7%)

Unsure if I paid estimated taxes correctly (18%)

Unsure of the process for freelancers (17.5%)

Not having kept track of deductions (13%)

Not having kept track of earnings (12.8%)

These challenges are actually differently prioritized for our respondents this year than they were last year. Last year, the top challenge was being unsure of the tax process for freelancers, which this year comes in fourth as the biggest challenge — perhaps indicating that there’s more education out there around the process, at least among this group of respondents.

This year, not knowing what qualifies as a deduction is the second biggest challenge, whereas last year it was the fourth biggest challenge. This could mean that independent workers this year are attempting to be more nuanced in how they track their taxes; now that they’re relatively sure of the process, they want to make sure they’re getting the details correct. Considering the flexibility of being an independent worker, different factors like setting up a home office or moving around the country that could trigger different withholding requirements might be on their mind as well.

For those filing for the first time, their biggest challenge is that they’re unsure of the process

For those who haven’t yet paid taxes as an independent worker before, the biggest challenges facing them are:

Unsure of the process for freelancers (19.5%)

Not having kept track of earnings (18.4%)

Unsure if I paid estimated taxes correctly (16.1%)

Not knowing what qualifies as a deduction (16.1%)

Not having kept track of deductions (15.7%)

Worried about the penalty for not paying estimated taxes correctly (14.2%)

Like the previous question, the challenges being faced by first-time filers have changed. Last year, the top two challenges were around deductions: not having kept track of deductions and not knowing what qualifies as a deduction. This year, concerns about deductions have fallen to fourth and fifth spots, and replaced with a more widespread concern about being unsure of the process for freelancers and not having kept track of earnings. Considering that in the last question, those who had filed as independent workers cited unsurety in the process as lower on their list of challenges, first-time filers may find that the act of going through the process will help them feel more comfortable with it in the future.

They file with an online tool (30%) or hire someone to do it (22%)

Considering the complexities in filing taxes, are independent workers trying to complete their taxes themselves or turning to professionals? The largest segment of respondents (30.4%) typically file online with a tool like TurboTax or H&R Block. The next largest segment (22.1%) hires someone to do it for them. 20.2% say they file manually themselves, and 14.8% have a family member or friend do it for them. Finally, 12.5% admitted that they don’t file taxes at all.

Compared to last year, there’s a slight shift from independent workers doing their own taxes to having them done by a professional. There’s a jump in independent workers filing online through TurboTax or H&R Block, from 24.4% last year to 30.4% this year. There’s also been a bump in respondents hiring someone to do their taxes, from 19.9% last year to 22.1% this year. Likewise, there’s been a drop in those filing manually themselves, from 25.7% last year to 20.2% this year. There’s also been a slight decrease in the number of those getting family and friends to do it, from 15.6% last year to 14.8% this year.

Given the complexities of independent worker income, this shift is likely due to independent workers wanting to bear less of the burden of manually figuring out their taxes and relying on professional guidance to do it.

More independent workers have switched to hiring someone for their taxes

As we saw above, approaches to doing taxes are shifting a bit. In uncovering more about that shift, we found that 40.3% of independent workers say they have not changed their method of doing taxes, as explained above. However, 31.9% have gone from doing it themselves to hiring someone. 27.8% have gone from hiring someone to doing it themselves.

47% don’t set aside part of their income every month for their taxes

For independent workers, federal and state taxes are not automatically withheld from their paycheck like they are with a W-2. This means that the responsibility falls to independent workers themselves to calculate what that tax amount should be and set it aside from their income in order to pay their estimated taxes.

But are independent workers actually setting aside that income? 53.4% replied that they do set aside income every month for taxes, but 46.6% do not.

This is a drop from last year in the number of independent workers setting aside income to pay estimated taxes each more. Last year, 59.7% replied that they set aside income every month for taxes, yet this year it’s only 53.4%.

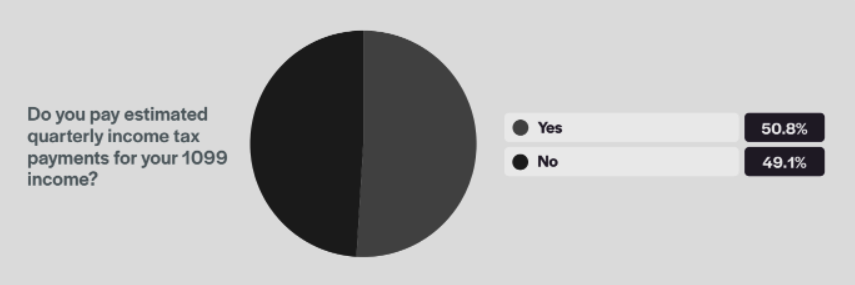

49% don’t pay their quarterly estimated tax payments

After setting aside estimated taxes, independent workers who will owe more than $1000 in taxes for the year should file estimated quarterly taxes with both the IRS and their state, in order to cover the taxes owed on their income for that quarter. (It’s not a necessity, but those who don’t pay estimated quarterly taxes face a penalty for underpayment if they don’t).

Are our respondents paying their estimated taxes each quarter? As we found, only half (50.9%) are paying quarterly taxes, and 49.1% are not.

Again, compared to last year, we’re seeing a drop in those who pay estimated quarterly tax payments, from 57.8% last year to 50.9% this year.

They don’t pay because they don’t know the process

As we found in the last question, half of independent workers don’t pay their estimated quarterly taxes. Here are the reasons why:

I don’t know the process (29.6%): The largest segment of our respondents aren’t clear on the process for paying their estimated quarterly taxes: when they should pay, what website they need to go to, what form to fill out, or other process questions.

I just wait until I file yearly and pay the penalty (26%): About a quarter don’t pay their estimated taxes quarterly, and simply wait until their yearly taxes are due and pay then.

I don’t have enough set aside (23.1%): Many also don’t pay because they’re not setting aside enough income, or not setting aside any income, to pay quarterly taxes.

I’m unaware that I should (21.3%): Finally, many aren’t aware that they should be paying estimated quarterly taxes at all, and that the tax process is different for independent workers.

We found the same top two reasons last year: “I don’t know the process” is the biggest reason why they don’t pay, with “I just wait until I file yearly and pay the penalty” being the second reason. This year, however, “I don’t have enough set aside” came in higher than last year. “I’m unaware that I should” came in last, which signals that, as compared to last year (26% last year), more independent workers do know the process, they just have other reasons for not paying.

46% of independent workers worry about being audited

Getting something wrong on your tax filing, knowingly or unknowingly, brings with it the fear of being audited — especially when you’re doing your own taxes. 45.6% do fear being audited, while 54.4% do not. Compared to last year, this is a bit of a drop in fear, as 50.9% in 2021 said they fear being audited, while 49.1% did not.

Section Summary:

A few key observations become clear in this section in regards to independent workers and taxes.

First, there’s significant confusion over how the process works of paying estimated quarterly taxes and filing yearly taxes. Nearly a third of those who don’t pay quarterly taxes don’t do so because they’re unsure of the process. For those filing for the first time, their biggest challenge is that they’re unsure of the process. This signals that there’s a lack of education, guidance, and support out there for independent workers on how to do this incredibly important and necessary business function. This is also a gap that needs to be filled as more and more individuals go independent.

Additionally, nearly half of independent workers don’t set aside income each month in order to anticipate their expected tax payments. This could be due to the aforementioned confusion around the process or not knowing that they should. It could also be a matter of not having enough money at the end of the month, and choosing between paying bills, buying groceries, or saving for future tax payments. It could also be a lack of education and awareness around how to budget for tax payments, not using separate accounts to keep track of it, or other logistics issues. Not setting aside income could even be due to a lack of automation — if the process was automated, would there be better adoption? What we found, too, is that the number of independent workers who don’t set aside income is growing.

Finally, we’re seeing a year-over-year shift from independent workers doing their own taxes, or having friends or family do them, to looking to professionals to help, either in the form of hiring an accountant or using online tools like TurboTax or H&R Block. It’s likely the complexities of non-W-2 taxes — or even the aforementioned confusion over the process — are drawing independent workers towards professional help.

Part 3: Current Status of Tax Filings

With tax day quickly approaching on April 18, 2022, independent workers have a lot of preparation to do in gathering receipts, adding up income, and finding all associated business transactions. Are they prepared to file their taxes by the deadline?

18% haven’t started their 2021 taxes and don’t expect to have it done by the deadline

With the April 18, 2022 deadline quickly approaching, are independent workers on track to file? As of March 14, 2022, the date of our survey, 35.2% have completed their taxes and have already filed. 26.3% replied that they’re working on it, and are on track for the April 18 deadline. 20.1% haven’t started yet, but say they will have it done by the April 18 deadline.

However, 18.3% haven’t started yet, and say they likely won’t be ready by the April 18 deadline. If there are 68 million independent workers, this would translate into nearly 12.5 million workers not being prepared to file and missing their deadline.

40% don’t have the funds available to meet their tax obligations

Considering that many don’t set aside income each month and haven’t paid quarterly tax payments, what is the level of concern over having enough funds available to pay their tax obligations? 60.4% believe that they’ll have enough, but 39.6% don’t think they’ll have enough funds to meet their tax obligations.

Compared to last year, there are fewer independent workers this year ready to meet their tax obligations. In 2021, 67.5% believed they’d meet their tax obligations, while only 60.4% believe the same this year.

63% are concerned they will owe more than they filed for

Because the responsibility lies with independent workers to calculate how much taxes they’ll owe on their income, at varying percentages depending on their income, are our respondents concerned that they didn’t get it right?

31.4% are very concerned that they’ll end up owing more than they filed, and 31.8% are somewhat concerned; in total, 63.2% have some kind of concern they’ll owe more. 36.8% don’t have concerns that they’ll end up owing more.

This is a bit lower concern this year than last year, when 68.6% were concerned they’d end up owing more than they filed for (37.7% very concerned and 30.9% somewhat concerned).

Nearly half are concerned because the process is confusing and they’re afraid they made a mistake

For those who are concerned about owing more than they thought, what are some of the main reasons why? Respondents are nearly split on their reasons for concern. The most-cited reason is that they feel the process is confusing, and they’re afraid that they made a mistake, which could result in higher payment (38.3%). Others have concerns that they didn't budget correctly (30.9%) or that they’re not sure they have the right documents (30.9%), both of which could result in paying more.

Section Summary:

When it comes to filing taxes for 2021, one-third of our respondents have filed already, and many are on track to finish. Many haven’t even started, however, and many aren’t expecting to be finished by the deadline.

Why is this? It could be due to poor planning, but considering one of the answers we heard over and over was that the process was confusing, it may be that: I’m not sure how to even start or what I need to do to complete it. Considering, too, that we found many independent workers haven’t set aside income to pay their quarterly taxes, there may be procrastination and fear around discovering what they’ll truly owe — especially since 63% are concerned they will owe more than they filed for, and 40% don’t have the funds available to meet their tax obligations.

Conclusion:

With 68 million independent workers currently — and with that number only projected to grow — the independent economy has a substantial and wide-spread future ahead of it. Independent work options like gig work, contract work, on-call work, and various other types give individuals the ability to follow a non-traditional career path, set their own hours or work location, or even just make some money on the side.

While the independent economy may be the future of work, the way independent workers deal with taxes is trapped in the past. With having to estimate and set aside income, pay estimated taxes, track expenses and deductions, and more, independent workers are also expected to take on the role of accountant every April — something W-2 workers don’t have to worry about.

Choosing to be an independent worker shouldn’t mean being penalized by a lack of transparency around how to file. It also shouldn’t mean having to navigate opaque and confusing systems and being left to figure out taxes with little guidance — and with the threat of audit or penalty hanging over their heads if they get a calculation wrong.

The independent economy can only grow quickly and strongly if the barriers to entry — like complicated taxes — continue to fall. Today and going forward, independent workers need tools and support to be able to navigate the world of work they choose to be a part of.