MyBKHelp Provides Free Confidential Assessment and Skilled Attorney Services for Bankruptcy Cases

Employing a team of highly-skilled professionals, MyBKHelp specializes in Chapter 7 and 13 bankruptcy law helping clients through the bankruptcy process and ensuring their fiscal health.

New York, NY, September 11, 2015 (Newswire.com) - MyBKHelp specializes in Chapter 7 and 13 bankruptcy law and provides skilled attorneys for legal assessment and services for bankruptcy cases. The organization helps clients understand the bankruptcy laws and provides legal representation throughout the process. MyBKHelp also offers a free confidential assessment to help clients understand their options.

Guided by commonsense legal advice, attorneys with MyBKHelp start with an assessment of a client’s current debt situation and review whether or not bankruptcy is indeed the best option. For some, other alternatives to bankruptcy are available, and if so, attorneys will guide clients to the best course of action for their particular situation. However, if bankruptcy remains the best option, MyBKHelp attorneys examine whether to file the claim under Chapter 7 or 13, depending on which yields greater financial benefits, and provides legal representation throughout the legal bankruptcy case.

A Good Bankruptcy Lawyer Can Make Things A Lot Easier.

MyBKHelp is a resource helping clients understand the often confusing bankruptcy laws and works to devise a plan to meet a client’s economic goals, including debt repayment strategies that ease the terrible burden on their family or company. In addition, the organization provides debt management and credit reconstruction, effective repayment planning, prevention of interest hikes and wage garnishment, filing legal documents, and in-court representation, among other services.

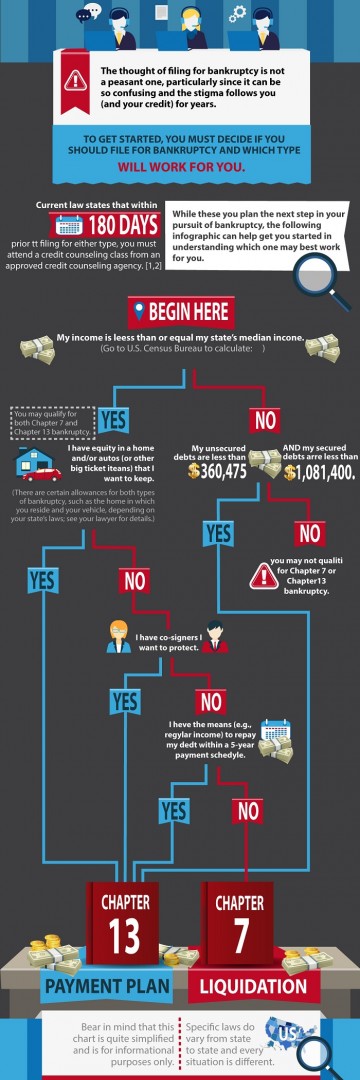

With the recent economic crisis, many who have never faced a financial hardships are having to make the difficult decision of bankruptcy. Many don’t know the differences between Chapter 7 and 13 bankruptcy. Chapter 7 bankruptcy is a clean slate method of removing all debts. It requires those filing to sell off all properties and use the proceeds to pay for all the debt. If there are not enough assets to cover the debt, with no other source of income to speak of, the insufficient debt payment will cancel all of the debt with a notice of discharge sent a few months thereafter. Chapter 7 bankruptcy is ideal for individuals who do not have a stable source of income or have extensive expenses that must be paid off on a regular basis. Possible triggers for a Chapter 7 bankruptcy include large medical expenses, being laid off, and marital problems as well as extensive credit problems.

In contrast, Chapter 13 allows those filing to hold on to some assets, such as the family home, while selling off some assets and using that revenue along with a portion of income to pay off the debts within a specific amount of time, usually covering three to five years. After that time, any debt left unpaid will be discharged accordingly. Chapter 13 gives the client a break from being hounded by creditors while having a grace period to pay off the debts without overtaxing finances. Chapter 13 bankruptcies are ideal for people who have a solid source of income but are having a hard time with all of the necessary expenses.

Attorneys with MyBKHelp are well-trained and educated, familiar with federal bankruptcy laws as well as local court systems, and have vast experience on the subject. For a free confidential assessment and to learn more about the organization, visit MyBkHelp.com or call 1-855-814-68-43.

ABOUT MyBKHelp

Employing a team of highly-skilled professionals, MyBKHelp specializes in Chapter 7 and 13 bankruptcy law helping clients through the bankruptcy process and ensuring their fiscal health. Attorneys with MyBKHelp are well-trained and educated, familiar with federal bankruptcy laws as well as local court systems, and have vast experience on the subject. For a free confidential assessment and to learn more about the organization, visit MyBkHelp.com or call 1-855-814-68-43.